FICA Tax Rate: What is the percentage of this tax and how you can calculated?

Por um escritor misterioso

Descrição

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hosp

Understanding Payroll Taxes and Who Pays Them - SmartAsset

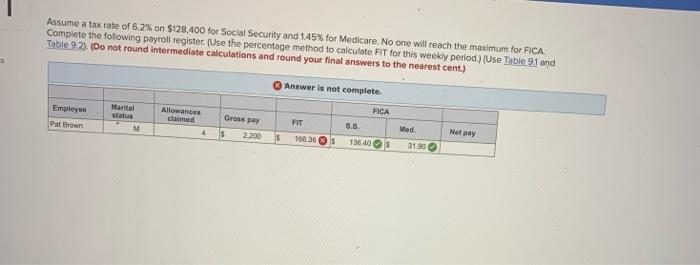

How To Calculate Federal Income Taxes - Social Security & Medicare Included

Solved Assume a tax rate of 6.2% on $128,400 for Social

Federal Insurance Contributions Act - Wikipedia

Easiest FICA tax calculator for 2022 & 2023

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

2023 Social Security Wage Base Increases to $160,200

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

Maggie Vitteta, single, works 37 hours per week at $15.00 an hour.

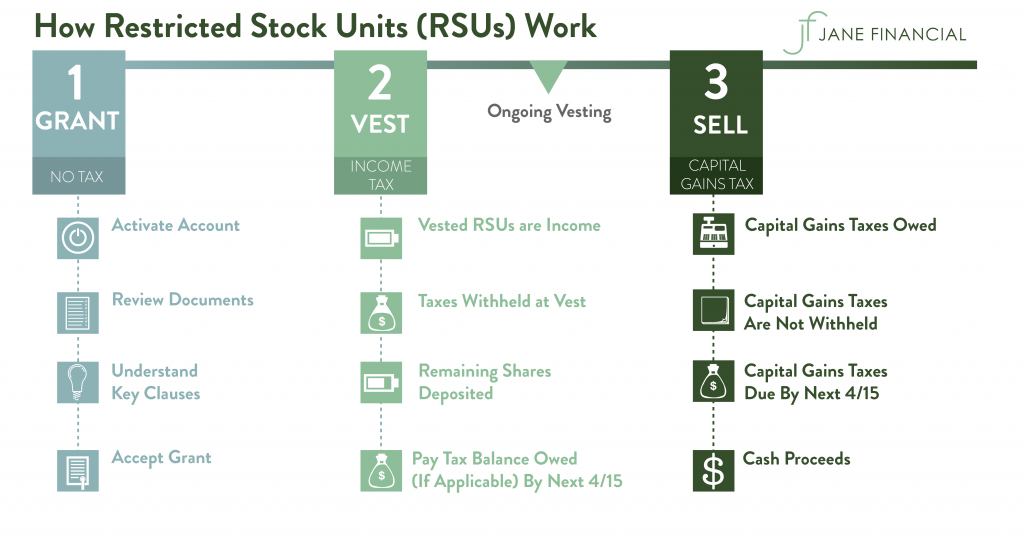

Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

de

por adulto (o preço varia de acordo com o tamanho do grupo)