FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

7 Steps to Starting an LLC in North Carolina - NerdWallet

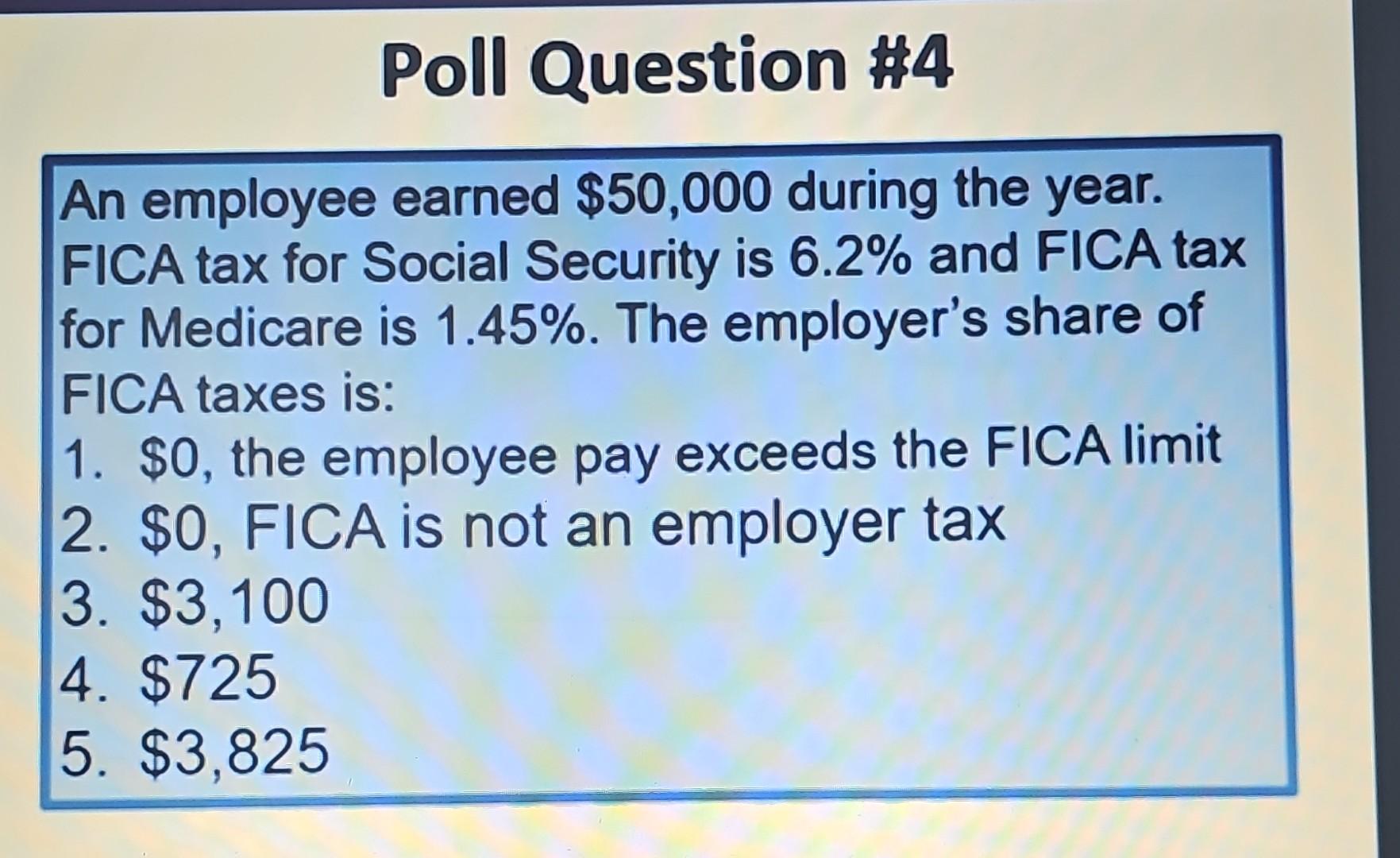

Solved An employee earned $50,000 during the year. FICA tax

Federal Insurance Contributions Act: FICA - FasterCapital

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

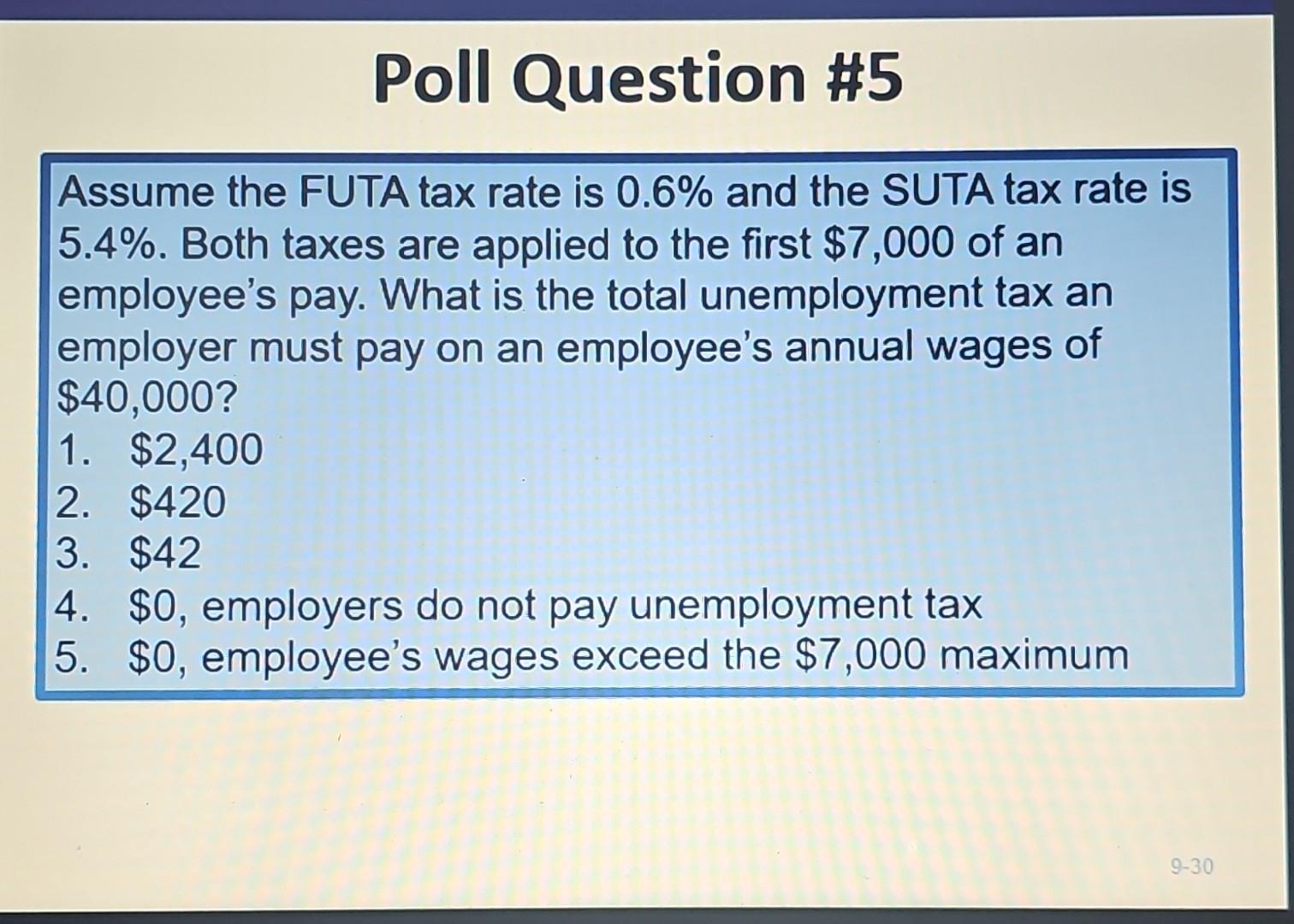

Payroll Taxes and Employer Responsibilities

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

Solved An employee earned $50,000 during the year. FICA tax

What is payroll tax?

Hiring Contract vs. Full-Time Workers - NerdWallet

2023-2024 Tax Brackets & Federal Income Tax Rates

Document

Estimated Tax Payments 2023: How They Work, When to Pay - NerdWallet

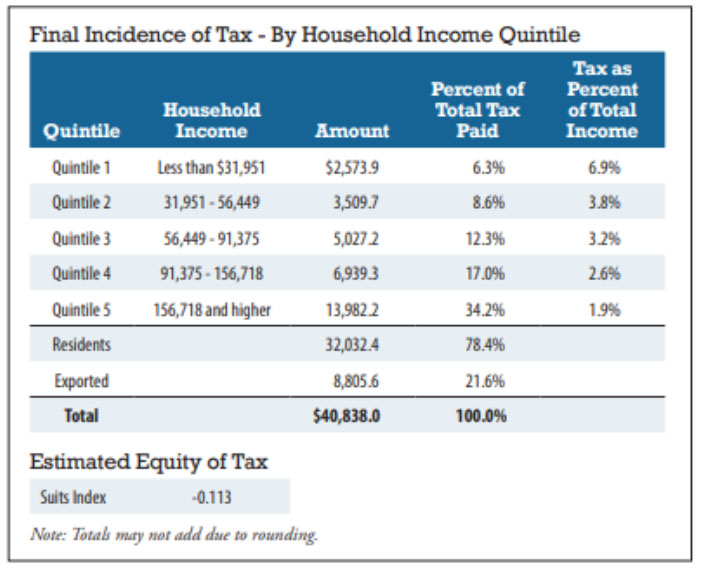

SUGGESTIONS FOR IMPROVING TAX COMPLIANCE THROUGH GREATER TAX SYSTEM TRANSPARENCY AND ACCOUNTABILITY - California Lawyers Association

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

How FICA & Federal Income Taxes Work - TaxSlayer®

de

por adulto (o preço varia de acordo com o tamanho do grupo)