FICA Tax: What It is and How to Calculate It

Por um escritor misterioso

Descrição

What is FICA tax? Learn what you need to know about this employee- and employer-paid federal tax that includes Social Security and Medicare.

Assume a tax rate of 6.2% on $128,400 for Social Security and 1.45

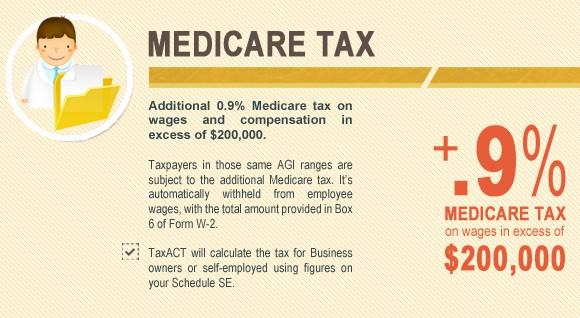

ACA Tax Law Changes for Higher Income Taxpayers

FICA Tax in 2022-2023: What Small Businesses Need to Know

FICA Tax: What It is and How to Calculate It

How to calculate self employment taxes

Payroll Tax Calculator for Employers

Taxable Social Security Calculator

What Is FICA Tax? —

What is FICA Tax? - The TurboTax Blog

TX302: Payroll Withholding Tax Essentials

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)

Learn About FICA Tax and How To Calculate It

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)