What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

Presidential Order Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster

CARES Act Allows Employers to Defer Employer Portion of Social Security Payroll Taxes - CPA Practice Advisor

IRS Fails on Guidance on Employee Payroll Tax Deferral

CARES Act Social Security Tax Deferral and Credit for Employers

Maximum Deferral of Self-Employment Tax Payments

Trump Memo on Payroll Tax Deferral Creates a Tax Nightmare - Alliance Law Firm International PLLC

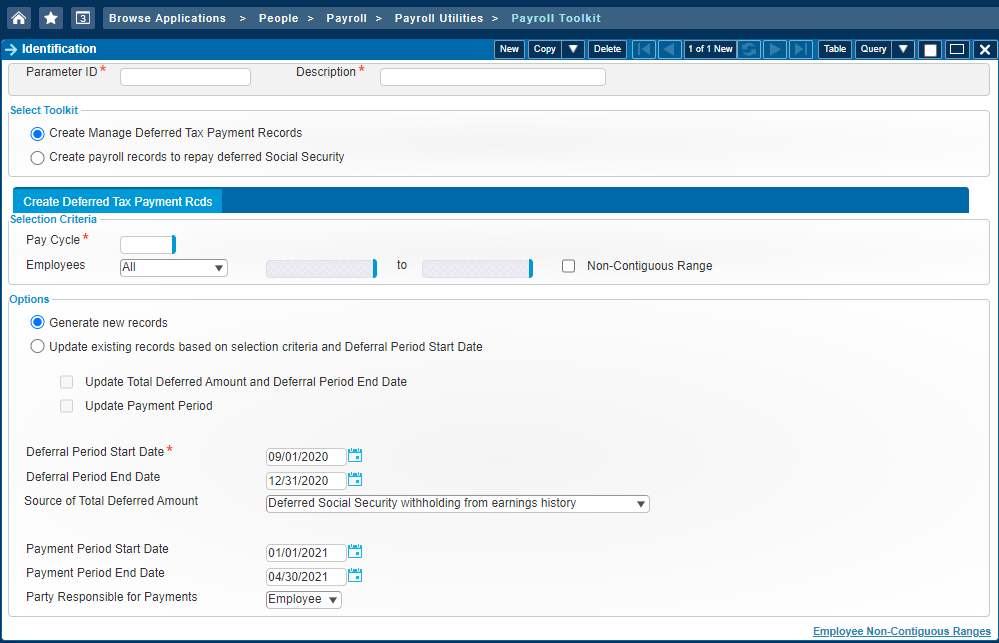

CARES Act & Deferral of Employer Social Security Payroll Taxes

What You Need to Know About the Payroll Tax Deferral - MilSpouse Money Mission

What Employers Need to Know About The CARES Act Payroll Tax Deferral

What you Need to Know about the Social Security Payroll Tax Deferral Program

COVID Updates

CARES Act Payroll Tax Deferral for Employers

Pay It Now or Pay It Later…What You Need to Know about Deferral of Employee Social Security Tax - PYA

Lacking Time and Guidance, Businesses Won't Defer Employees' Payroll Taxes

Colleges Make Limited Use of Available Pandemic-Related Tax Relief

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)