What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Descrição

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Program Explainer: Windfall Elimination Provision

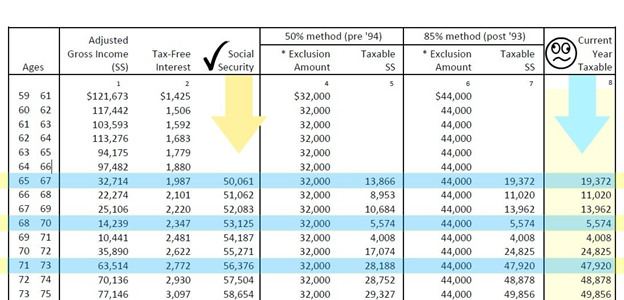

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85%

What is a payroll tax?, Payroll tax definition, types, and employer obligations

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

How Is Social Security Tax Calculated?

Research: Income Taxes on Social Security Benefits

Research: Income Taxes on Social Security Benefits

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits

Tax Exempt - Meaning, Examples, Organizations, How it Works

Clergy Taxes: Understanding Social Security: Medicare with IRS Pub 517 - FasterCapital

Taxable Social Security Calculator

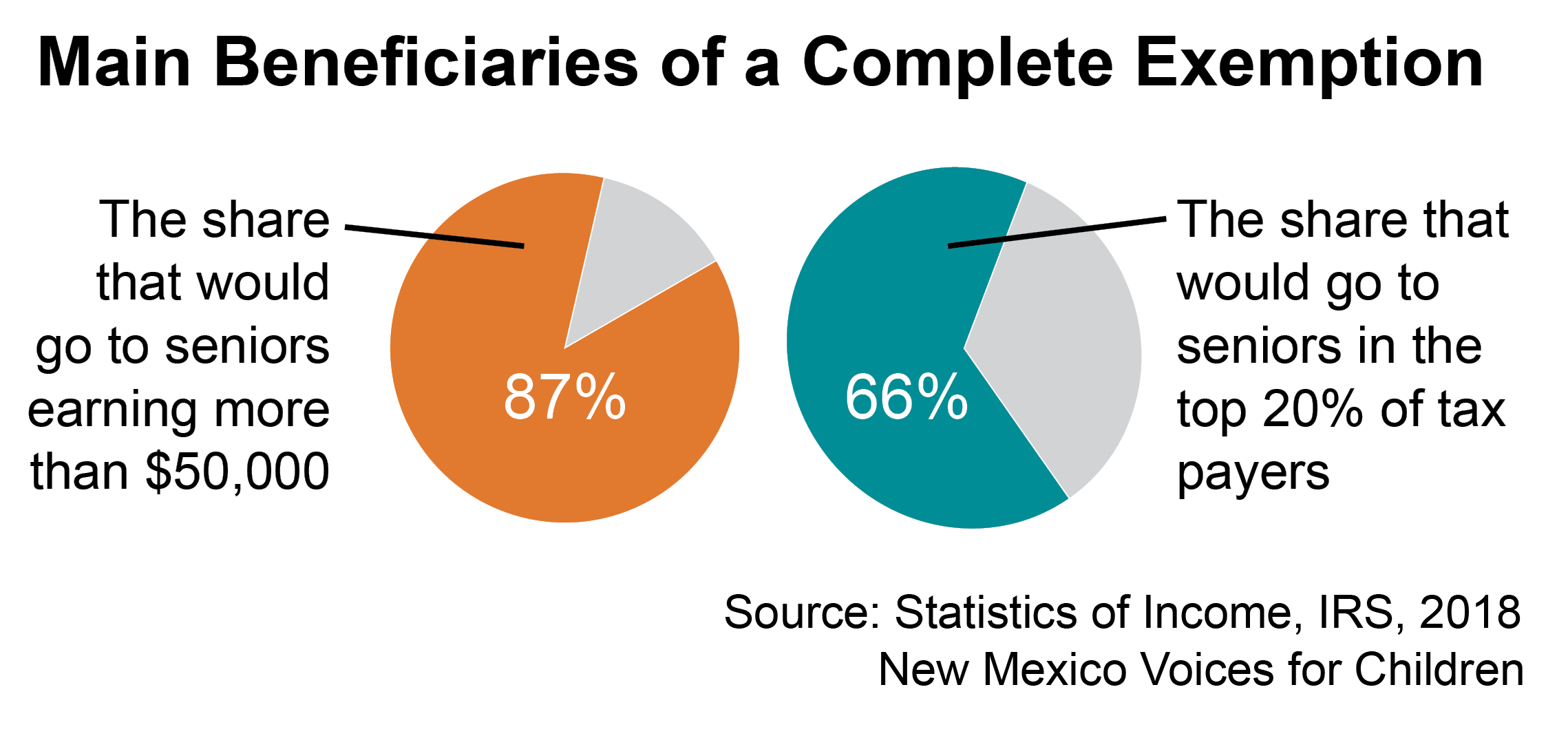

Exempting Social Security Income from Taxation: Not Targeted, Not Necessary, Not Cheap – New Mexico Voices for Children

Which Organizations Are Exempt from Sales Tax?

de

por adulto (o preço varia de acordo com o tamanho do grupo)