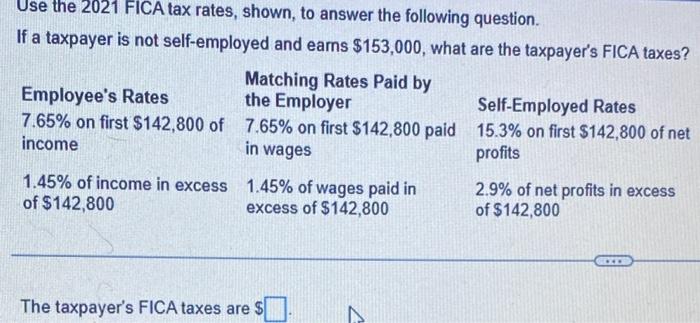

2021 FICA Tax Rates

Por um escritor misterioso

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Maximum Taxable Income Amount For Social Security Tax (FICA)

Financial Considerations for Moonlighting Physicians

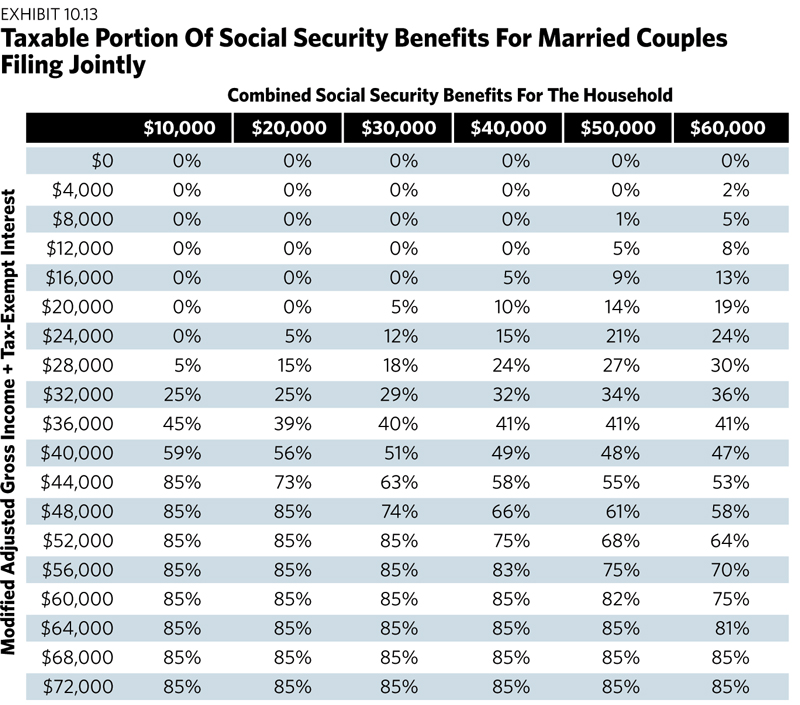

Avoiding The Social Security Tax Torpedo

Solved Use the 2021 FICA tax rates, shown, to answer the

Payroll Tax Rates and Contribution Limits for 2022

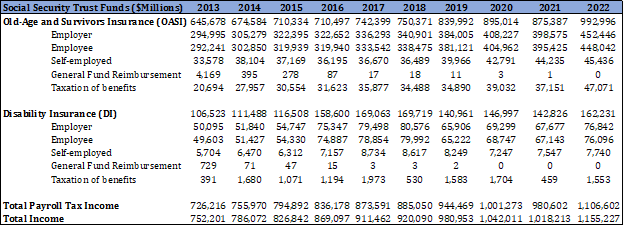

What are the major federal payroll taxes, and how much money do they raise?

Social Security Financing: From FICA to the Trust Funds - AAF

The 2021 “Social Security wage base” is increasing - WellsColeman

What are FICA Taxes? 2022-2023 Rates and Instructions

Research: Income Taxes on Social Security Benefits

IRS Announces Annual PCOR Fee Adjustment

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

Will I Have to Pay Taxes on My Social Security Income?

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates - CheckmateHCM

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

.jpg)