What are FICA Tax Payable? – SuperfastCPA CPA Review

Por um escritor misterioso

Descrição

CE Overview – Connecticut Pharmacists Association, 49% OFF

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits

MPI_0501 FICA Tip Credit Report

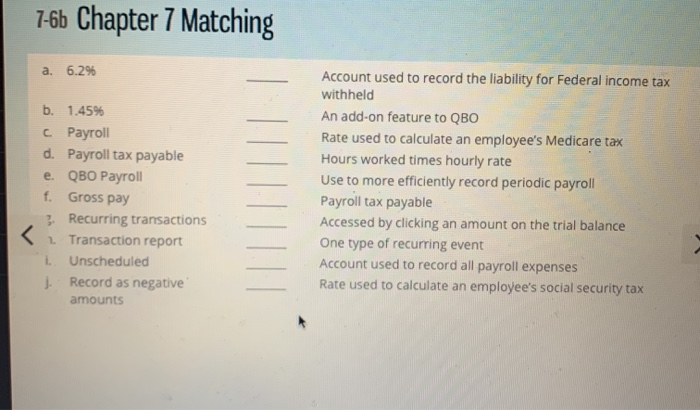

Solved 7-6b Chapter 7 Matching a. 6.2% b. 1.45% c Payroll d.

Investment Banking Flashcards & Quizzes

Fight Inflation: Buy These 10 Items Now Before Prices Go Up

Samples & Guides - SuperfastCPA CPA Review

Reg Notes 17, PDF, Law Of Agency

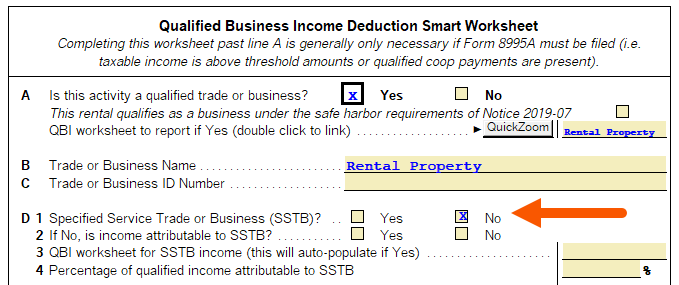

How to enter and calculate the qualified business income deduction, section 199A, in ProSeries

CP05A : r/IRS

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

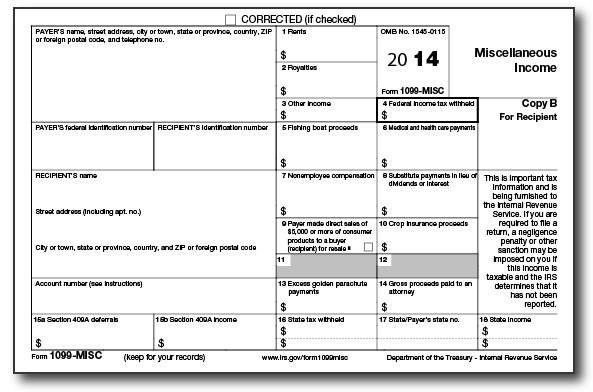

Form 1099 Compliance Best Practices…It's that Time of the Year Again!

IRS Notice CP210 Tax Lawyer Answer to IRS - TaxHelpLaw

de

por adulto (o preço varia de acordo com o tamanho do grupo)