Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Descrição

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

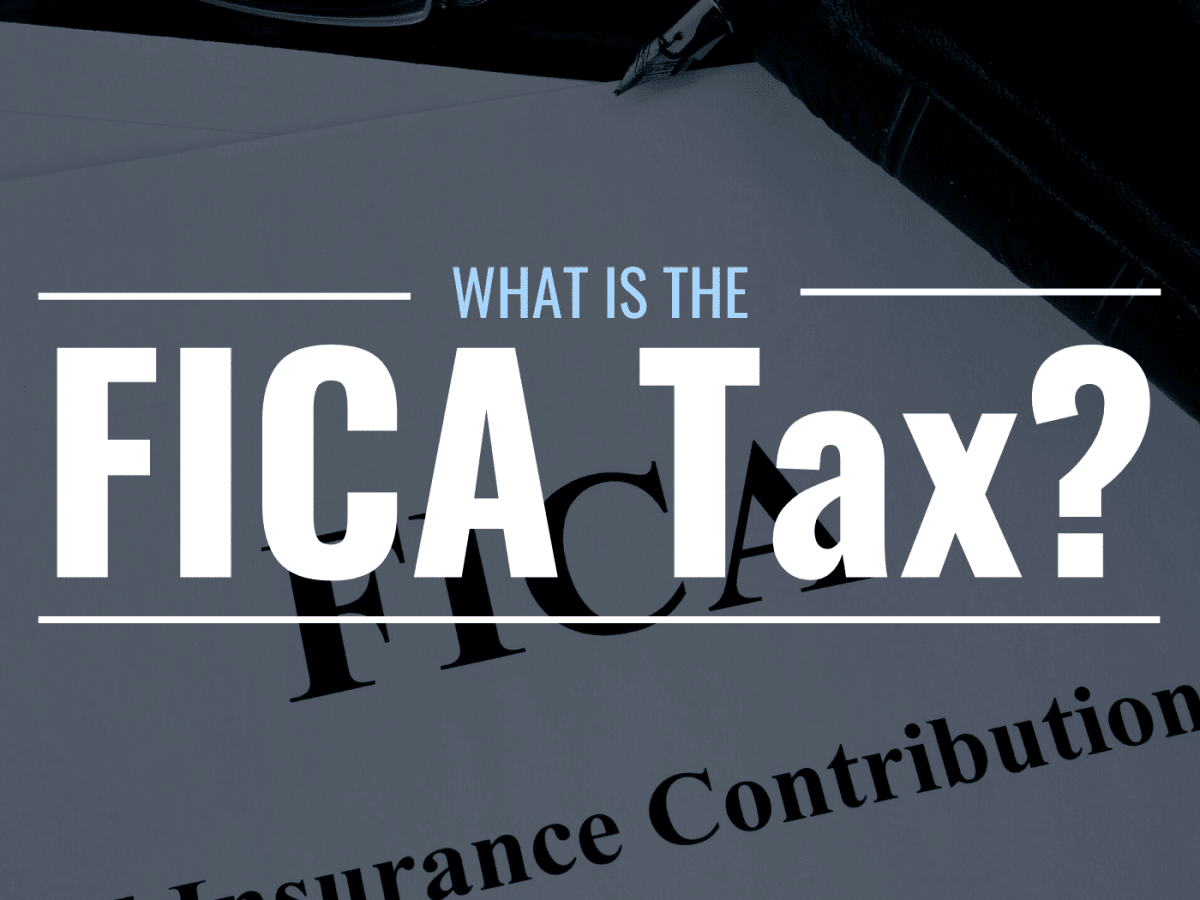

What Is the FICA Tax and Why Does It Exist? - TheStreet

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

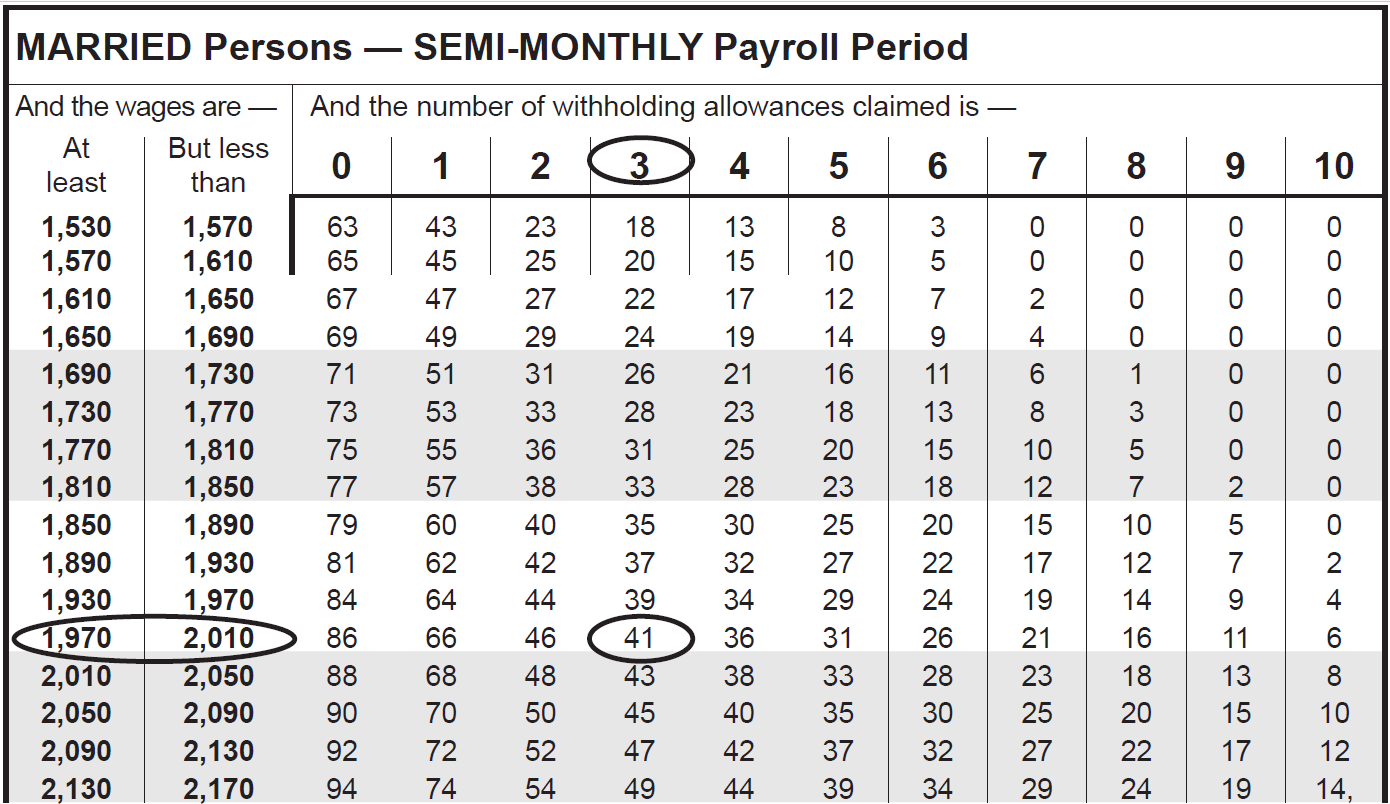

Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Payroll Services - Non-Resident Alien

Federal Insurance Contributions Act - Wikipedia

IRS 515: Withholding of Tax Foreign Corporations - eduPASS

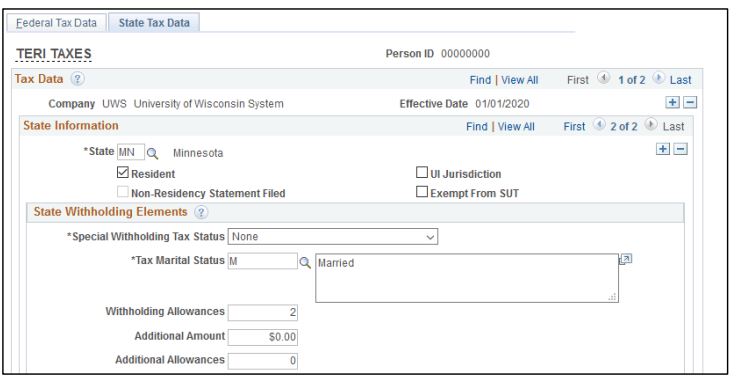

UW–Shared Services KnowledgeBase

Required Tax Forms University of Michigan Finance

US Tax Guide for Foreign Nationals - GW Carter Ltd

FICA and Medicare Payroll Tax FICA Stands for Federal Insurance

Students on an F1 Visa Don't Have to Pay FICA Taxes —

Which Employees Are Exempt From Tax Withholding? - Payroll

de

por adulto (o preço varia de acordo com o tamanho do grupo)