FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Descrição

Both employees and employers are required to pay FICA tax, which is withheld from an employee

FICA Tax Rate: What is the percentage of this tax and how you can calculated?

What Are FICA Taxes And Do They Affect Me?, by M. De Oto

What Is FICA Tax?

How To Calculate Payroll Taxes? FUTA, SUI and more

What is FICA Tax? - The TurboTax Blog

2019 Payroll Taxes Will Hit Higher Incomes

What are FICA Taxes? 2022-2023 Rates and Instructions

What Is FICA Tax: How It Works And Why You Pay

FICA Tax: Understanding Social Security and Medicare Taxes

Social Security payroll tax cap change could boost struggling benefits program - Don't Mess With Taxes

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

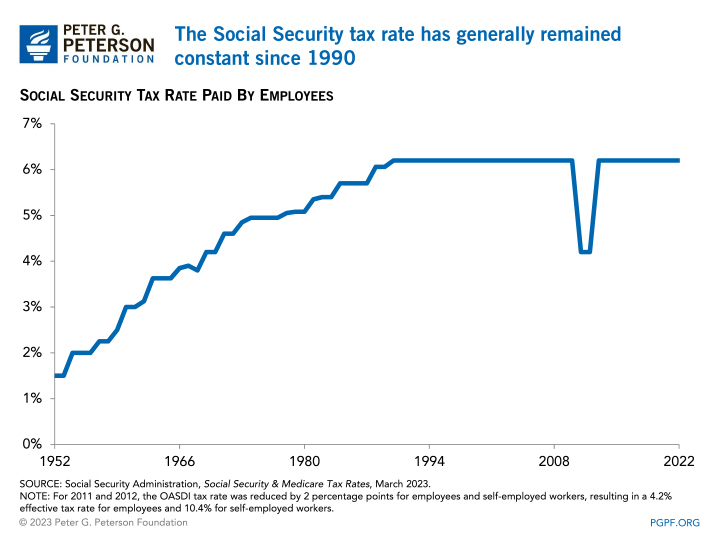

Payroll Taxes: What Are They and What Do They Fund?

13 States That Tax Social Security Benefits

de

por adulto (o preço varia de acordo com o tamanho do grupo)