Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Descrição

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Social Security Administration Announces 2022 Payroll Tax Increase

What Is FICA on a Paycheck? FICA Tax Explained - Chime

Fixing Social Security and Medicare: Where the Parties Stand - The

Understanding payroll tax & how to calculate it

What are FICA Taxes? 2022-2023 Rates and Instructions

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

Social Security (United States) - Wikipedia

What is FICA

What Is FICA Tax? A Complete Guide for Small Businesses

How Avoiding FICA Taxes Lowers Social Security Benefits

Payroll Taxes: What Are They and What Do They Fund?

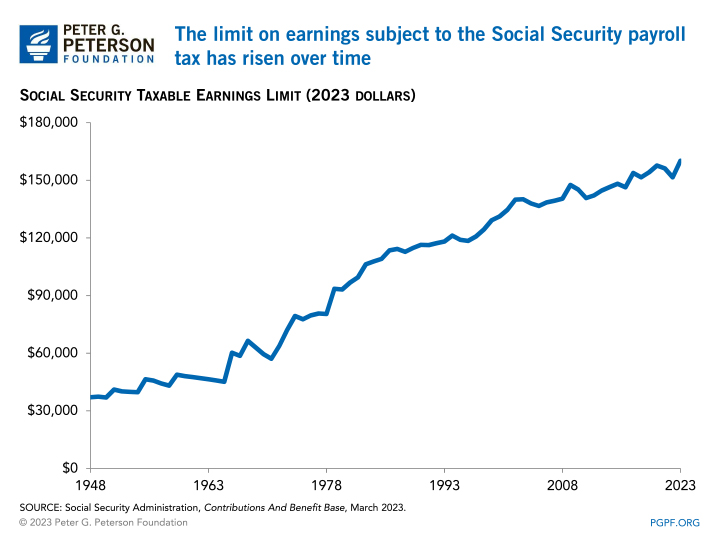

Historical Social Security and FICA Tax Rates for a Family of Four

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)