Brazil central bank to tighten digital asset regulation amid 44% spike in investment - CoinGeek

Por um escritor misterioso

Descrição

From January to August, Brazilians invested $7.4 billion in digital assets, attracting the central bank's attention, which wants to curb digital currency money laundering.

Brazil's central bank moves closer toward CBDC launch in 2024 - CoinGeek

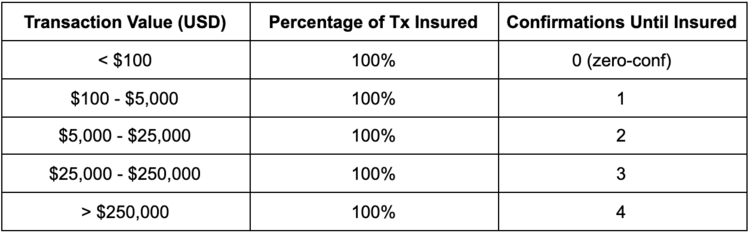

An offer for profit-seeking exchanges - CoinGeek

Brazil Lenders Embrace Blockchain Ahead of Central Bank's Digital Real Launch - Bloomberg

BSVBlockchain: A transparent and auditable record of transactions., Kendall McK posted on the topic

North Carolina bans CBDCs with passage of new bill - CoinGeek

Brazil central bank to tighten digital asset regulation amid 44% spike in investment - CoinGeek

BSVBlockchain: A transparent and auditable record of transactions., Kendall McK posted on the topic

Brazil's central bank endorses Itaú's DeFi liquidity pool proposal - CoinGeek

Brazil's digital real makes its debut on a public blockchain - CoinGeek

Blockchain Enterprise News

de

por adulto (o preço varia de acordo com o tamanho do grupo)