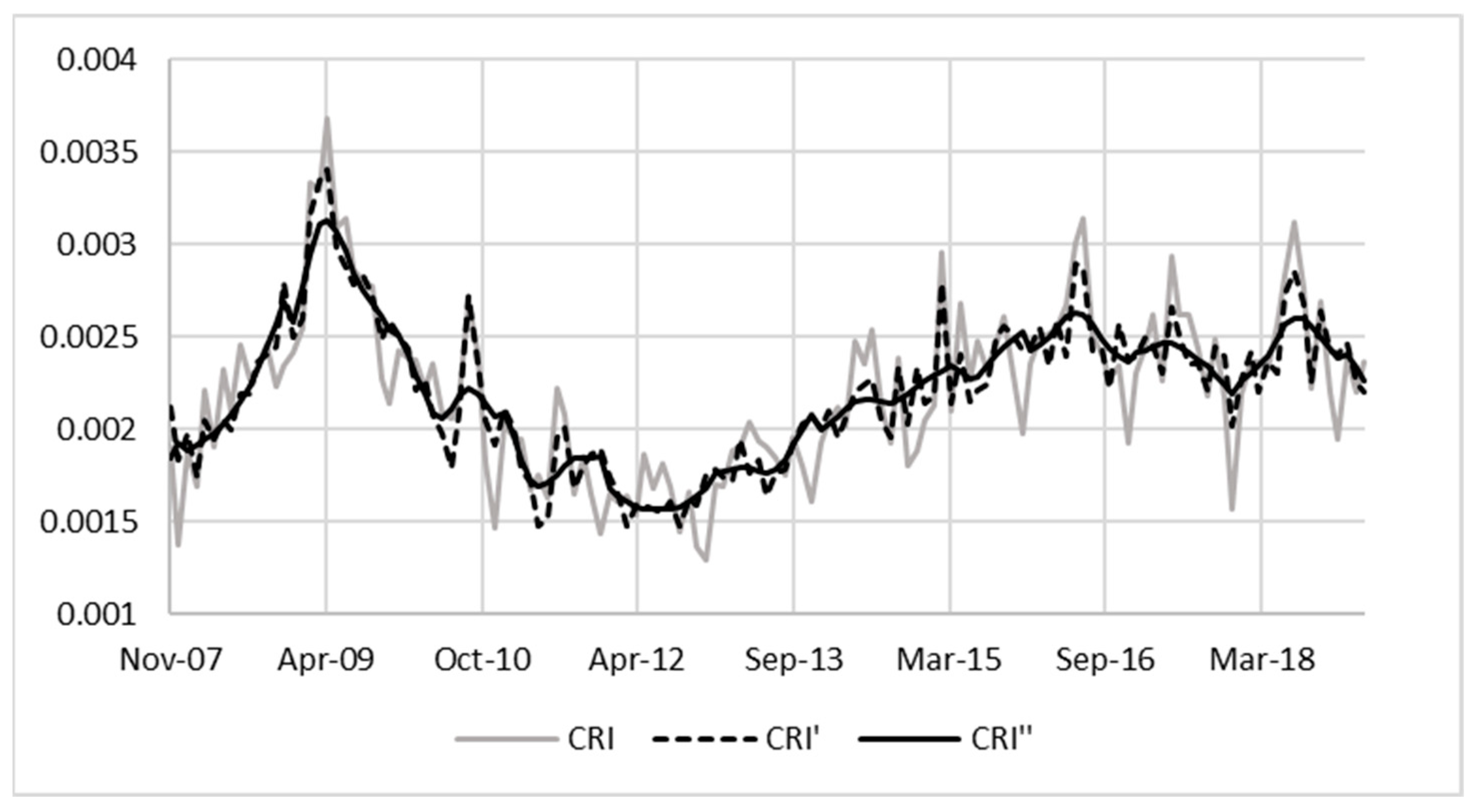

Eurozone Crisis and Banks' Creditworthiness: What is New for Credit Default Swap Spread Determinants? - Alessandra Ortolano, Eliana Angelini, 2022

Por um escritor misterioso

Descrição

Linear regression of firm-level log degree (y-axis) on log total assets

Selected Eurozone sovereign spreads (five-year credit default swap

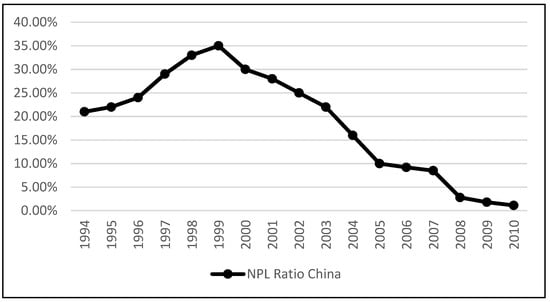

Percentages of banks' non-performing loans to total gross loans. Grey

The process of parameter estimate

Greece: Bank funding costs (blue) vs. bond funding costs (green, red).

Evolution of the number of active nodes, the number of links formed and

Risks, Free Full-Text

Risks Special Issue : Credit Risk Management

Eliana ANGELINI, Università degli Studi G. d'Annunzio Chieti e Pescara, Chieti, UNICH, Department of Economics

Moving decomposition of the R2

Ratio of new bad debts to outstanding loans (1)

Selected Eurozone sovereign spreads (five-year credit default swap

Histogram of network heterogeneity measure

PDF) Fundamental determinants of credit default risk for European and American banks

de

por adulto (o preço varia de acordo com o tamanho do grupo)