The advisory has directed taxpayers to check bank validation for

Por um escritor misterioso

Descrição

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

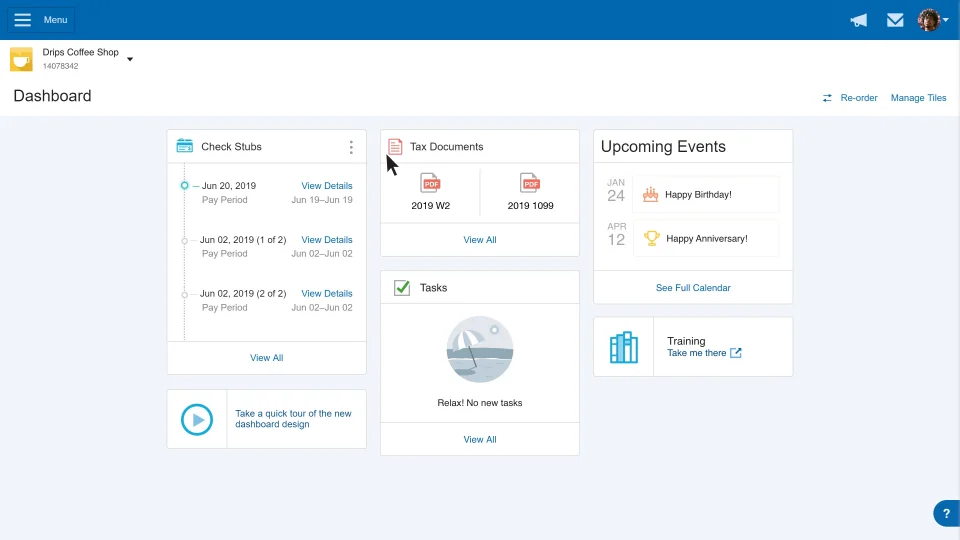

W-2 Frequently Asked Questions

Form of Subscription Agreement for Morgan Stanley Smith Barney LLC

GSTN issued advisory on Bank Account Validation

IRS IP PINs Now Available to All Taxpayers - Santora CPA Group

More on the Delta tunnel validation lawsuit: Coverage, commentary, and legal documents – MAVEN'S NOTEBOOK

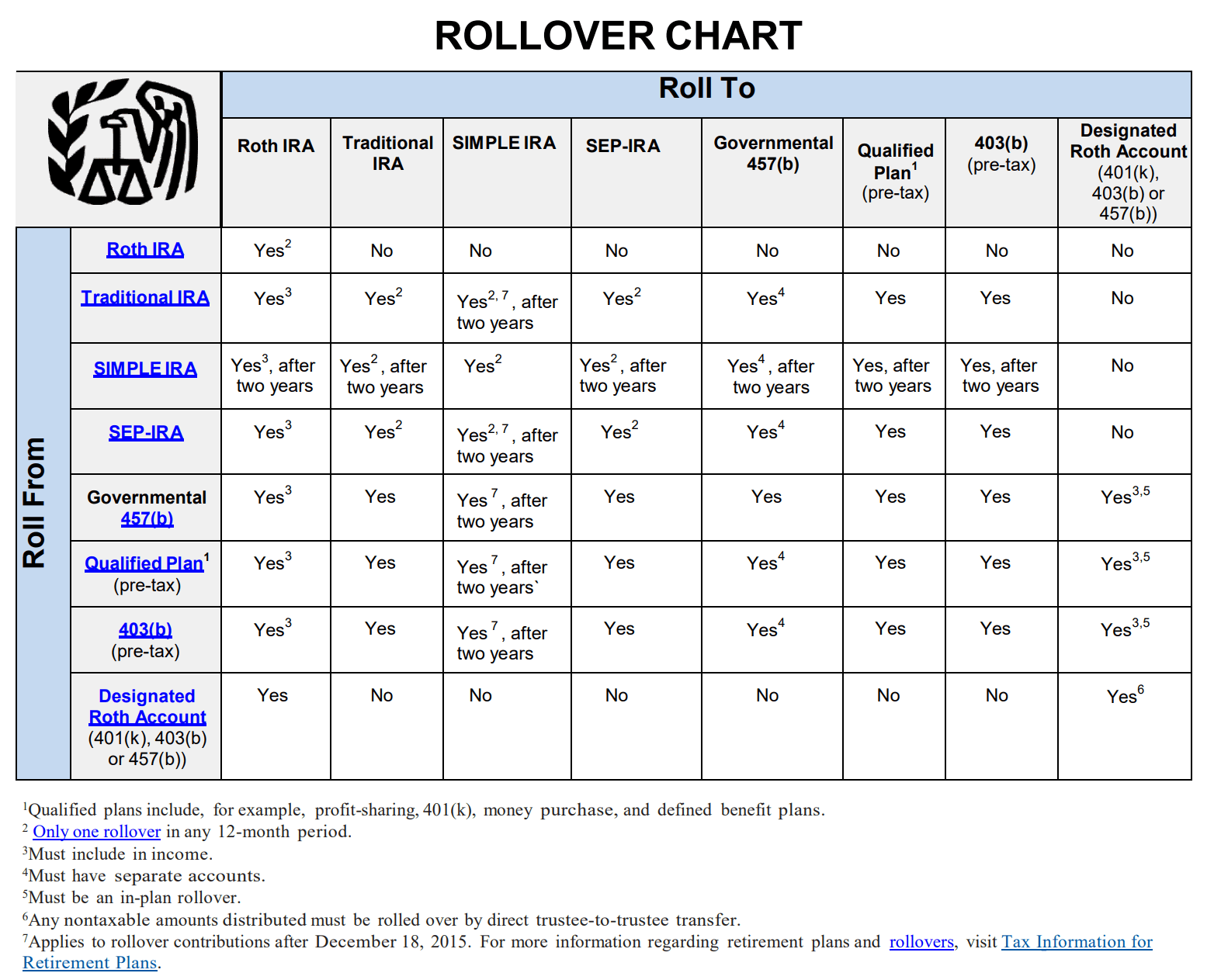

Learn the Rules of IRA Rollover & Transfer of Funds

32.3.2 Letter Rulings Internal Revenue Service

:max_bytes(150000):strip_icc()/Term-Definitions_Probate-bf79cb6063454b90b59346dbb0cfd099.jpg)

Probate: What It Is and How It Works With and Without a Will

Risky Business: What Attorneys Need To Know About the Recent Bank Failures - New York State Bar Association

Retirement Cornerstone Series CP Application for an Individual Annuity

Tracking regulatory changes in the Biden era

Understanding the GSA Schedule Financial Verification Process

de

por adulto (o preço varia de acordo com o tamanho do grupo)