Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Descrição

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

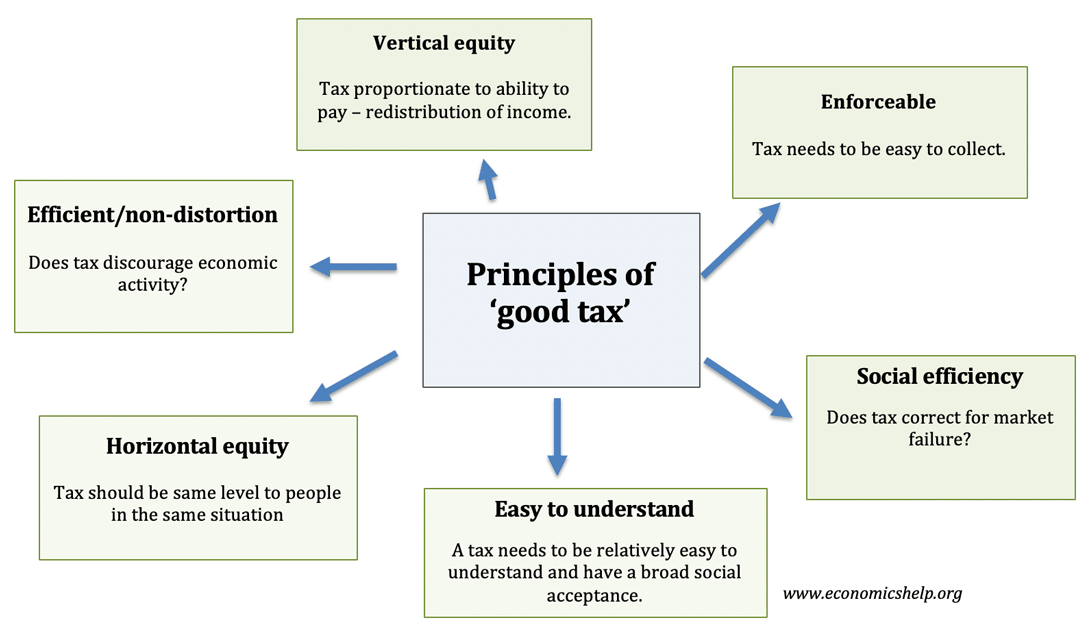

The qualities of a good tax - Economics Help

Budget 2011-2012: Speech of Pranab Mukherjee, Minister of Finance

Government intervention in Markets

Henry George's Single Tax Could Combat Inequality - The Atlantic

How to Calculate Income Tax on Salary with Example

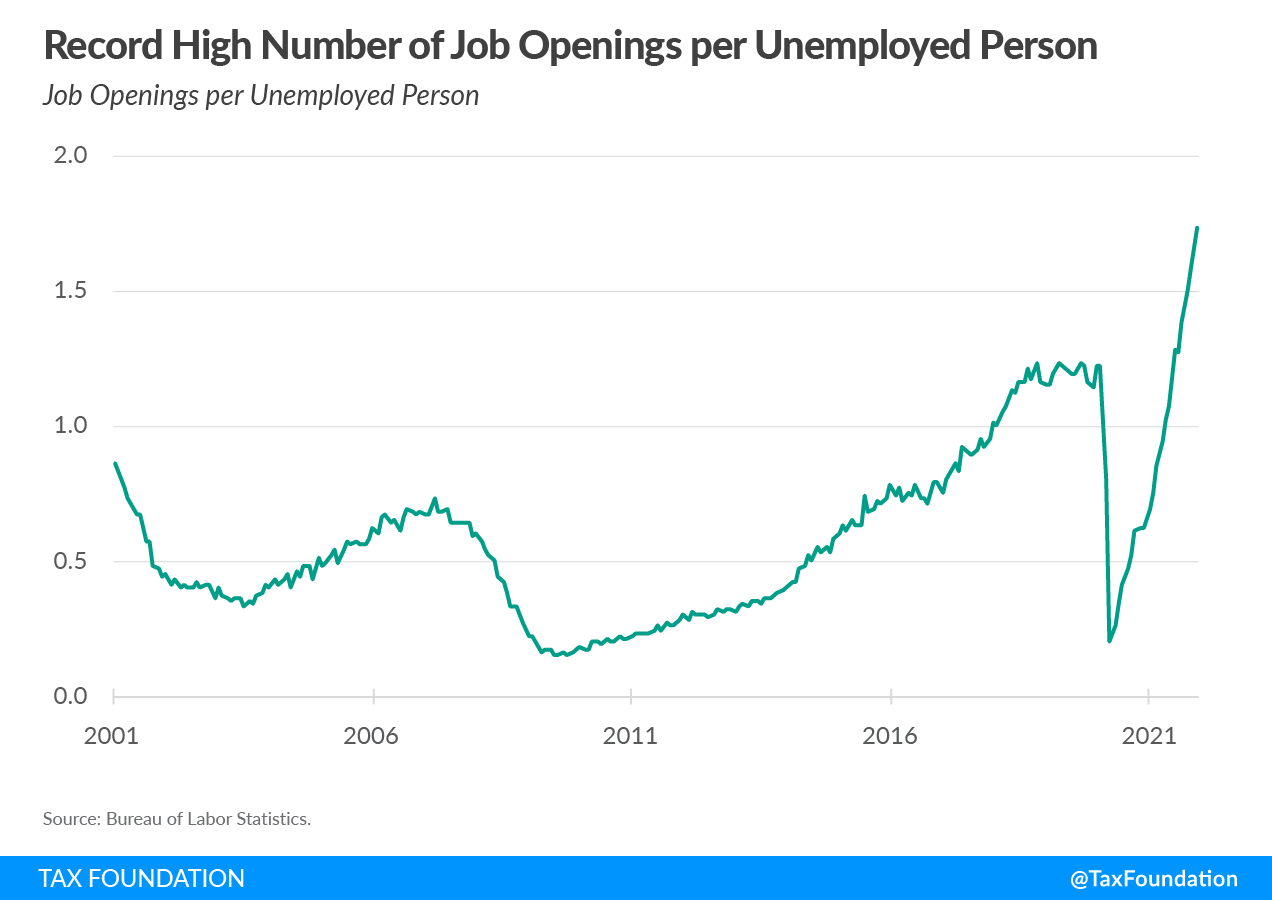

10 Tax Reforms for Economic Growth and Opportunity

Taxing wealth by taxing investment income: An introduction to mark

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)

What Is Tax Avoidance and How Is It Different From Tax Evasion?

India's PE/VC market: The quest for refined performance metrics

Tackling the tax code: Efficient and equitable ways to raise

A Comprehensive Guide on Tax Reforms for 2022

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/Law-of-Diminishing-Marginal-Utility-7334854b88ad474bbb7e97ae928eac88.jpg)