How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Descrição

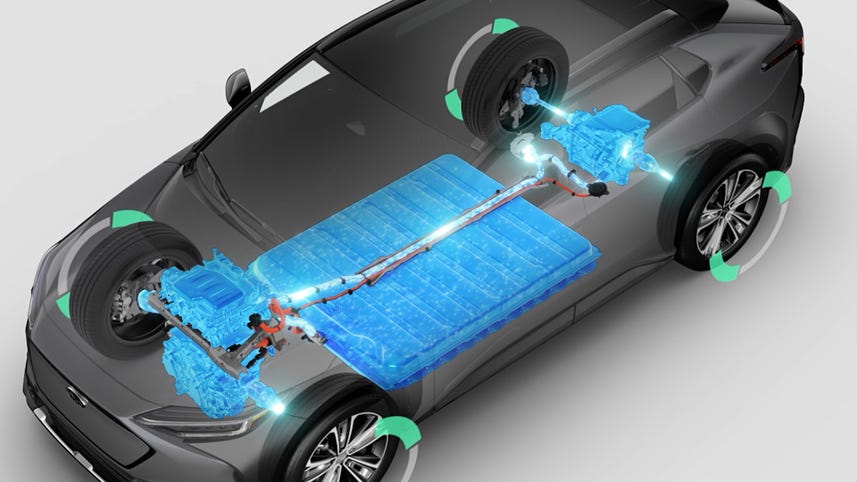

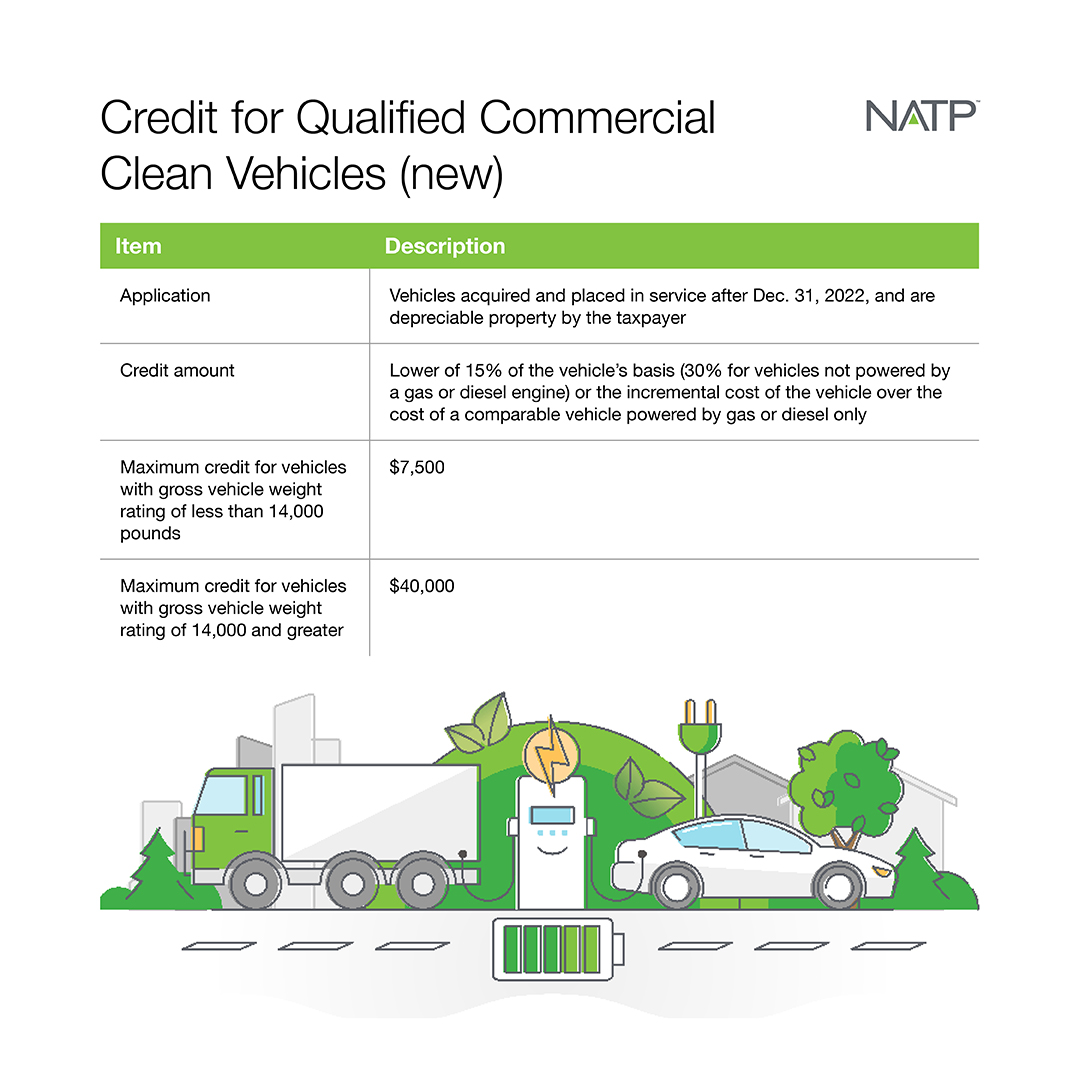

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

2023 EV Tax Credit: How to Save Money Buying an Electric Car

Tax Credits for Electric Vehicles Are About to Get Confusing - The New York Times

Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable

Clean vehicle tax credit: The new industrial policy and its impact

Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit - TurboTax Tax Tips & Videos

How to claim a $7,500 EV tax credit: What to know about 2023 IRL rules

What to know about the $7,500 IRS EV tax credit for electric cars in 2023 : NPR

Clean Energy Tax Credits Get a Boost in New Climate Law, Article

What tax incentives encourage alternatives to fossil fuels?

National Association of Tax Professionals Blog

de

por adulto (o preço varia de acordo com o tamanho do grupo)