Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

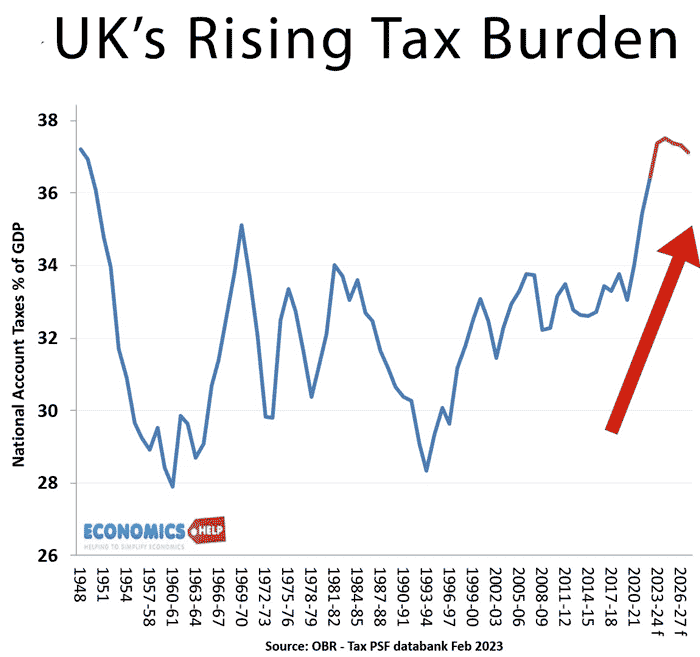

Why the UK Faces Higher Taxes and Less Public Services - Economics Help

:max_bytes(150000):strip_icc()/consumption-tax.asp_FINAL-96e3b673009d46b8b71253303e0efa38.png)

Consumption Tax: Definition, Types, vs. Income Tax

Value-Added Tax (VAT): A Guide for Business Owners

The Value-Added Tax Is Wrong for the United States

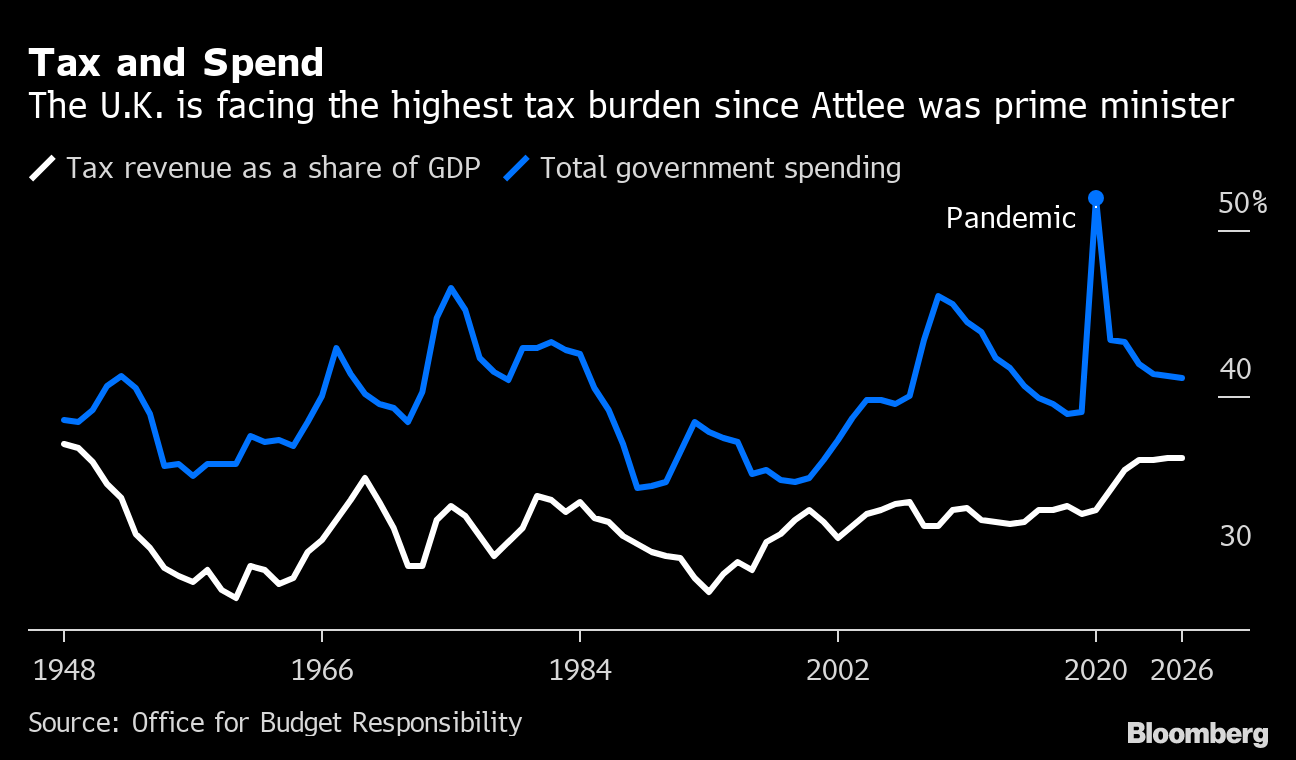

Spring Statement: UK Treasury to Raise £27 Billion More Tax Despite Tax Cut - Bloomberg

The Value Added Tax in the United Kingdom

Value-added tax: What is VAT and who has to pay it? - Avalara

How to handle value-added tax (VAT)

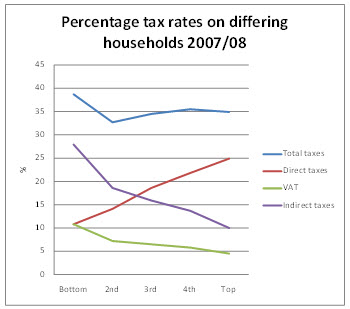

Why VAT is regressive

de

por adulto (o preço varia de acordo com o tamanho do grupo)