Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

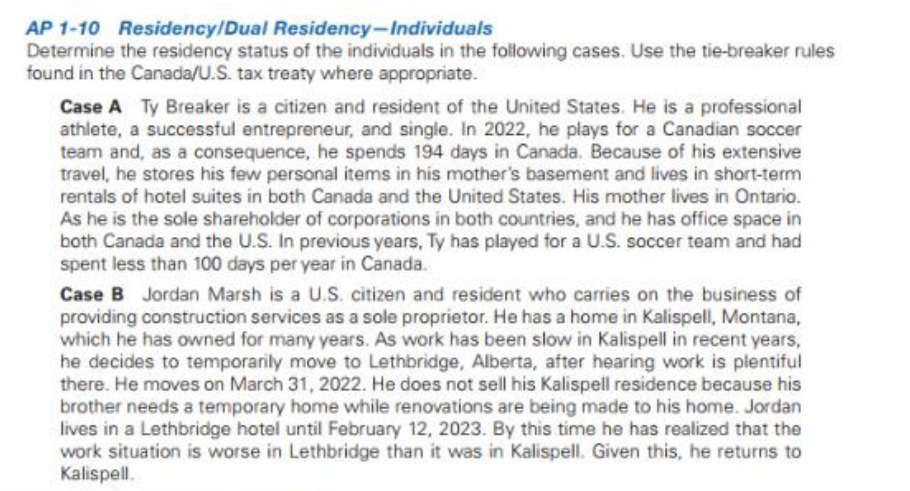

Solved P1-10 Residency/Dual Residency-Individuals etermine

What being an Australian resident for tax purposes means for you

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

2023 International Tax Competitiveness Index

Canada - U.S. Tie breaker rule - HTK Academy

Residency under Tax Treaty and Tie Breaker Rules

Residency Tie Breaker Rules & Relevance

Us taxation of foreign nationals

Why the Tax Dependency Exemption Benefit is Important for Federal Employees

U.S. Tax Issues For Visitors And Work Permit Holders

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/https://skoob.s3.amazonaws.com/livros/589330/O_ESPETACULAR_HOMEMARANHA_A01_1464981463589330SK1464981463B.jpg)

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2023/e/e/52bVvwTjGU1hWZUQc9ng/captura-de-tela-2023-12-07-233803.png)