FICA explained: Social Security and Medicare tax rates to know in 2023

Por um escritor misterioso

Descrição

What is the FICA Tax and How Does It Work? - Ramsey

Social Security wage base is $160,200 in 2023, meaning more FICA

Federal Tax Income Brackets For 2023 And 2024

FICA Tax: What It is and How to Calculate It

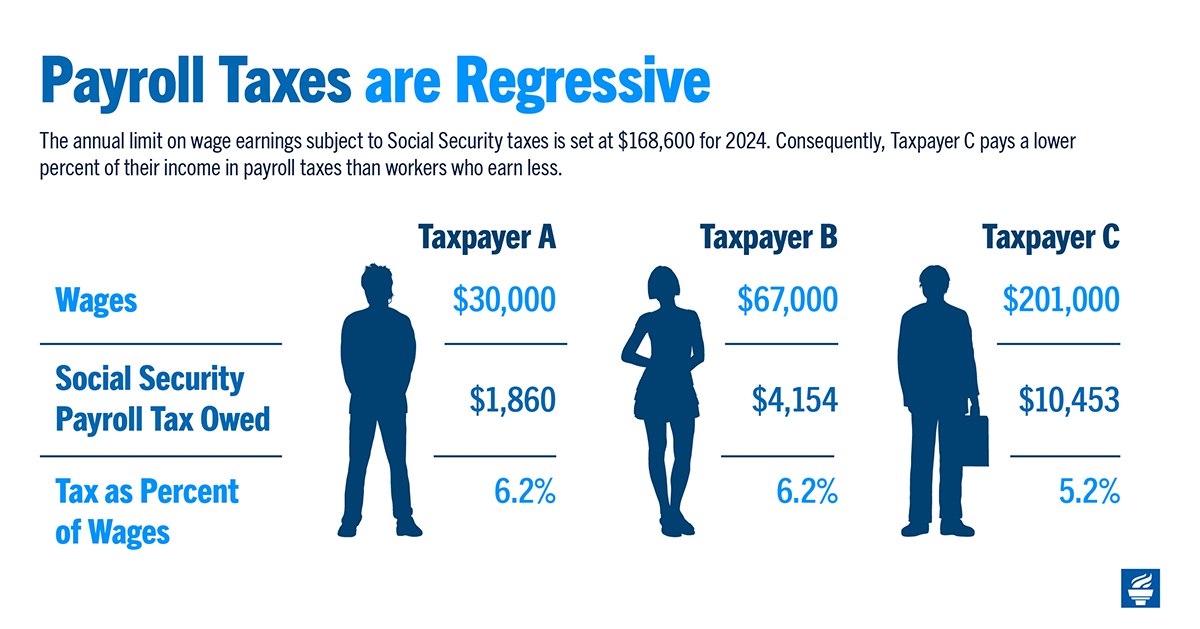

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

What are FICA Taxes? 2022-2023 Rates and Instructions

2021 Wage Cap Rises for Social Security Payroll Taxes

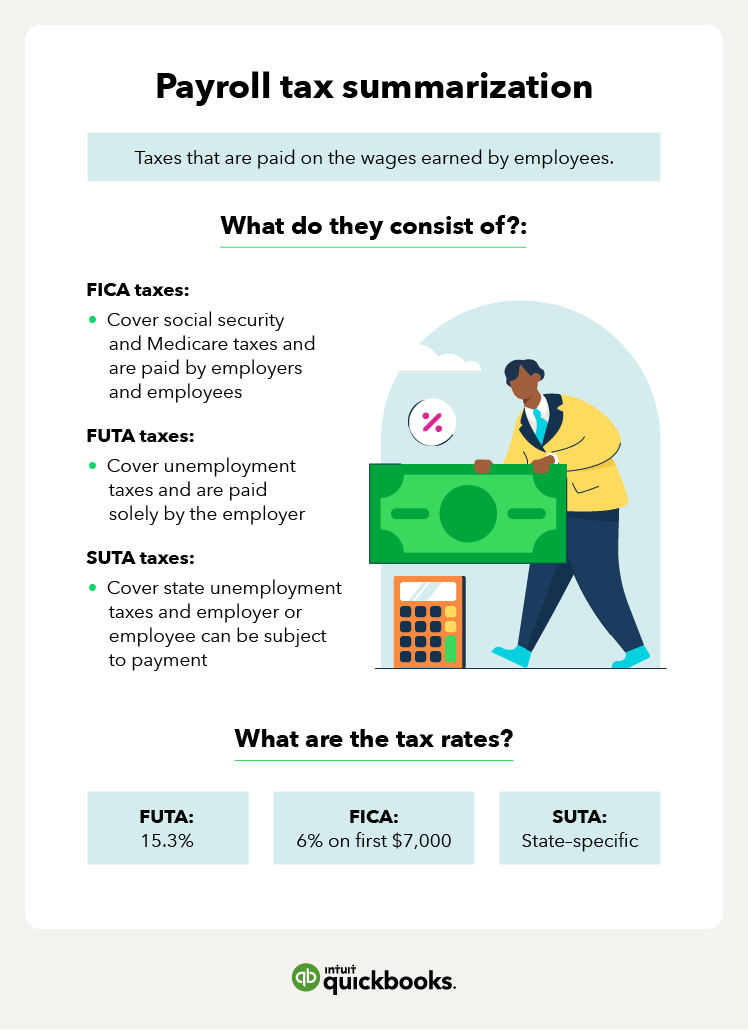

What is a payroll tax? Payroll tax definition, types, and

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

What Are FICA Taxes And Why Do They Matter? - Quikaid

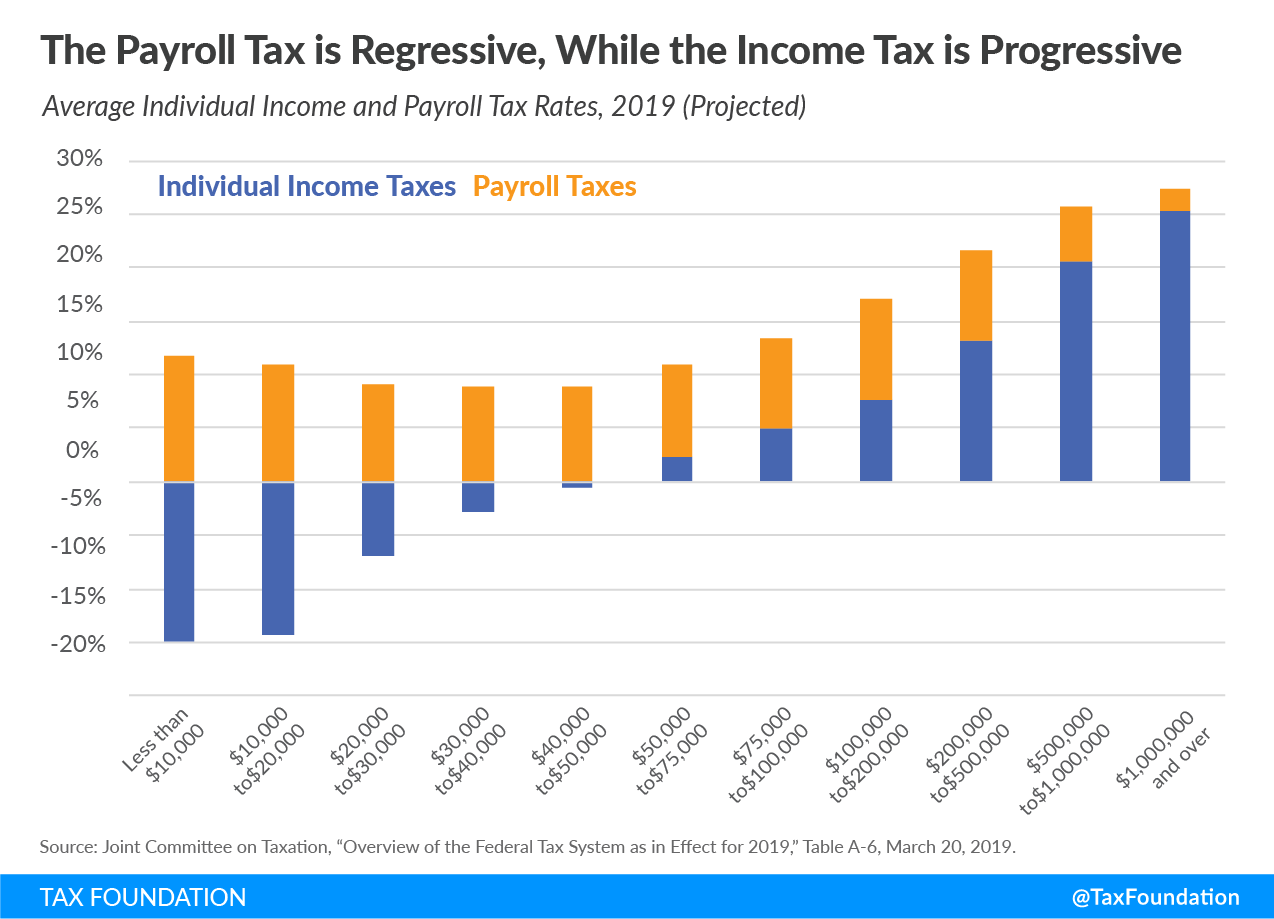

Most Americans Pay More in Payroll Taxes Than in Income Taxes

Research: Income Taxes on Social Security Benefits

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

What Is And How To Calculate FICA Taxes Explained, Social Security

The Social Security tax rate for employees is 6.2 percent, a

de

por adulto (o preço varia de acordo com o tamanho do grupo)