MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

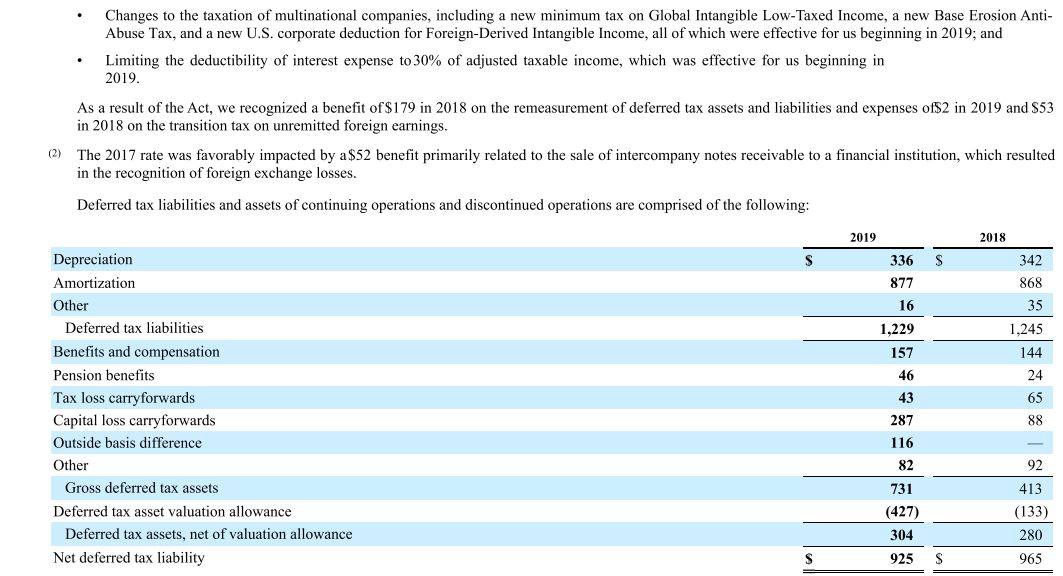

SEC Filing Lockheed Martin Corp

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DY66ULGMPJN3RKE7MFTAOF5374.jpg)

COVID-19's new expatriate employees

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZZKLJYCN3JNXNBKEVV2V3ELZGQ.jpg)

China extends tax breaks for foreign workers until 2027

U.S. Expats Archives

Rockey & Associates

India arms of 1,000 MNCs asked to pay GST on expat salaries, allowances

Multinationals, Capital Export, and the Inclusive Development Debate in Developing Countries: The Nigerian Insight

Passthrough-entity treatment of foreign subsidiary income

MNCs challenge GST notices on services received from expats - The Economic Times

)

GST Tax Demand: India arms of 1,000 MNCs asked to pay GST on expat salaries, allowances

.png)

TAX GUIDELINES FOR EXPENDITURES RELATED TO COVID-19

Colgate HR Case Study, PDF, Multinational Corporation

Income Tax: note 12 pg 67- 69 What is the effective

Host-based compensation approaches revisited

de

por adulto (o preço varia de acordo com o tamanho do grupo)