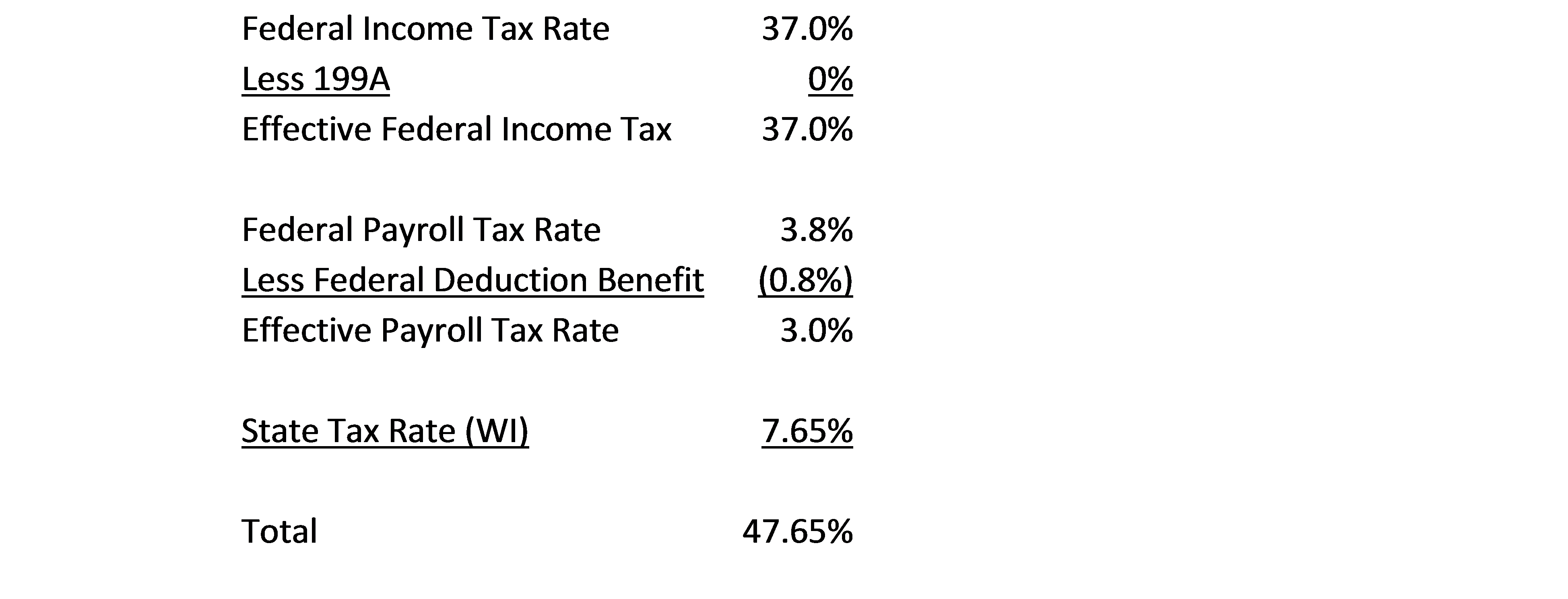

How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Ideas to Help Small Business Owners Reduce Taxes for 2023

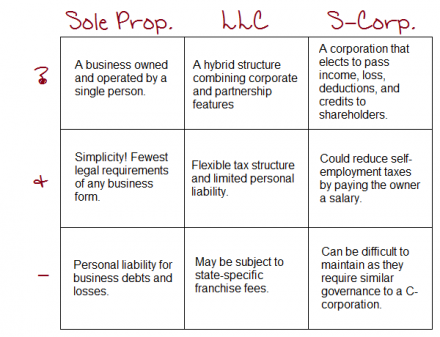

The S-Corporation

How to Minimize and Avoid Your Self-Employment Taxes

Creating an S corporation entity can reduce self-employment tax - Tax Pro Center

Tax Foundation Needs to Fix Their Map - The S Corporation Association

Using an S corporation to avoid self-employment tax

Use an S corporation to mitigate federal employment tax bills — N&K CPAs, Inc.

S Corporation Tax Benefits, CT Corporation

Why You Should Form an S Corporation (and When)

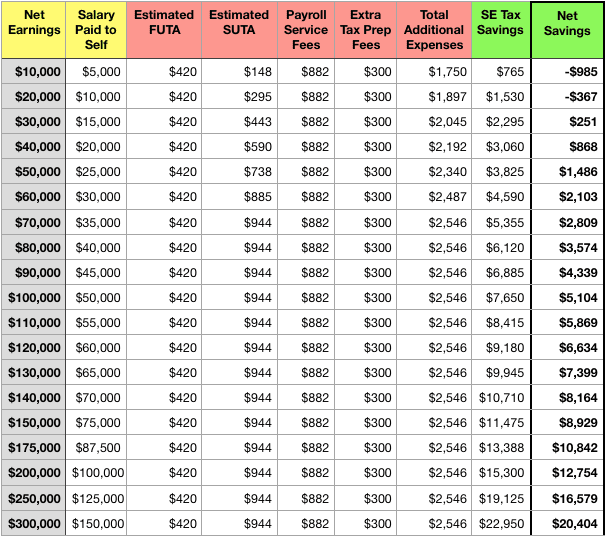

Here's How Much You'll Save In Taxes With an S Corp (Hint: It's a LOT)

Avoid Self Employment Tax - S Corp Election - Reduce SE Tax - WCG CPAs & Advisors

FICA Tax in 2022-2023: What Small Businesses Need to Know

Optimal choice of entity for the QBI deduction

de

por adulto (o preço varia de acordo com o tamanho do grupo)