What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax

Por um escritor misterioso

Descrição

Your company always uses to deduct a certain amount from your each pay period. Payroll taxes are the means through which the government receives this money.

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

Easiest FICA tax calculator for 2022 & 2023

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 2110

Prior pay period paycheck stubs and selected payroll data fo

How To Calculate Federal Income Taxes - Social Security & Medicare Included

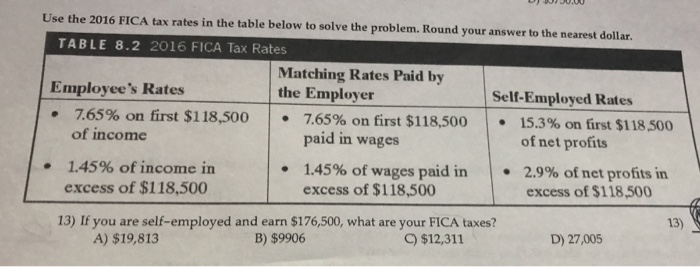

Solved D JU.00 Use the 2016 FICA tax rates in the table

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

7 Ways to Pay Less Taxes on Social Security Benefits

Income Taxes: What You Need to Know - The New York Times

How To Pay IRS Quarterly Estimated Taxes Online — Don't Let Your Checks Get Buried or Lost In The Mail

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

FUTA vs: FICA: Distinguishing Between Federal Payroll Taxes - FasterCapital

Paloma Co. has four employees. FICA Social Security taxes ar

de

por adulto (o preço varia de acordo com o tamanho do grupo)