Engineering Proceedings, Free Full-Text

Por um escritor misterioso

Descrição

In response to the rapid development of the global economy and FinTech innovation, Taiwan’s government has continuously promoted digital transformation policies for the financial industry and encouraged the industry to strengthen infrastructure constructions and upgrade innovative financial services and patents. Novel ideas are proposed to create a new situation and make banks invincible but it is questionable if such innovations necessarily bring competitiveness or business performance. To answer this question, we analyzed market competition using the PR test and data envelopment analysis (DEA) to study the operational efficiency of banks. K-means were also used to segment banks into three groups, Leader, Chaser, and Laggard. The data included financial (business performance) and patent data (innovation) of Taiwan’s banks from 2013 to 2020. The research results revealed that the market competition in the Leader group was the most intense. Quasi-public banks were relatively inefficient in creating revenue, while private banks were more efficient. The Chaser group showed the most apparent changes in operational efficiency from 2013 to 2020. The banks in the Laggard group needed to strengthen the relative efficiency of revenue, and financial innovation needed to be individualized in this competitive market group.

Toward a Post-Pandemic World: Lessons from COVID-19 for Now and

Understanding current causes of women's underrepresentation in

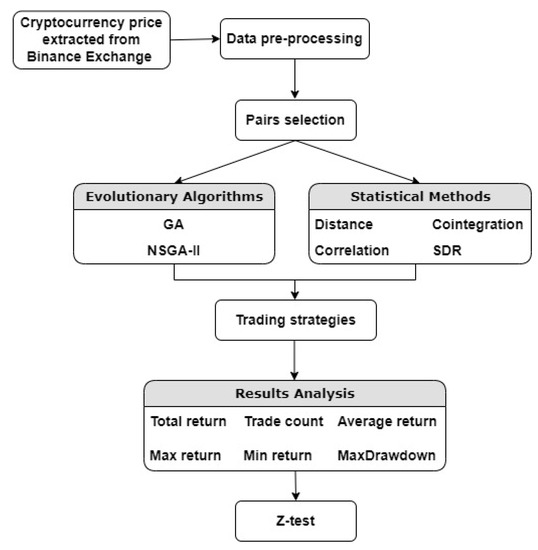

Genetic Algorithms And Investment Strategies Download - Colaboratory

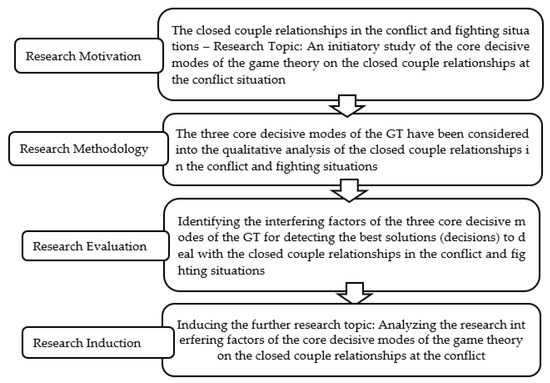

Game Theory Conflict Analysis - Colaboratory

Engineering Village Search and discovery platform to answer

Engineering Psychology and Cognitive Ergonomics: 19th

Engineering Proceedings IEEC 2022 - Browse Articles

Materials Today: Proceedings, Journal

Conference Proceedings Template - American Institute of Physics

Digital Commons Network (Open Access, Powered by Scholars

de

por adulto (o preço varia de acordo com o tamanho do grupo)