Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

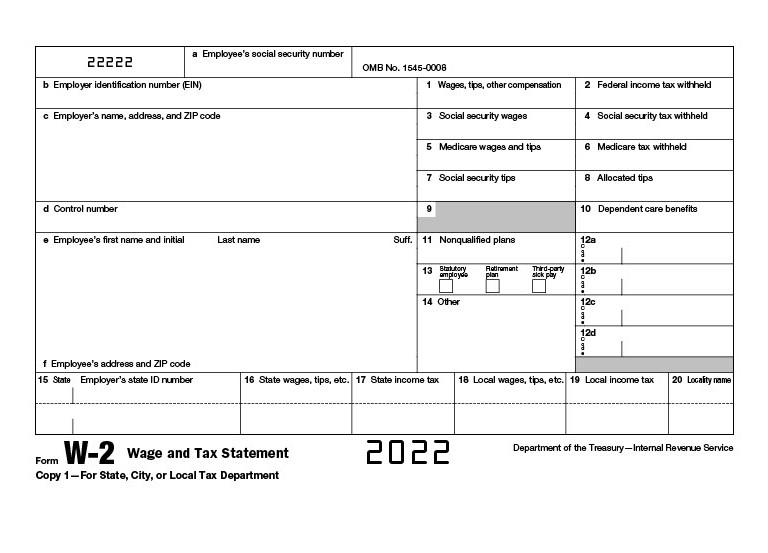

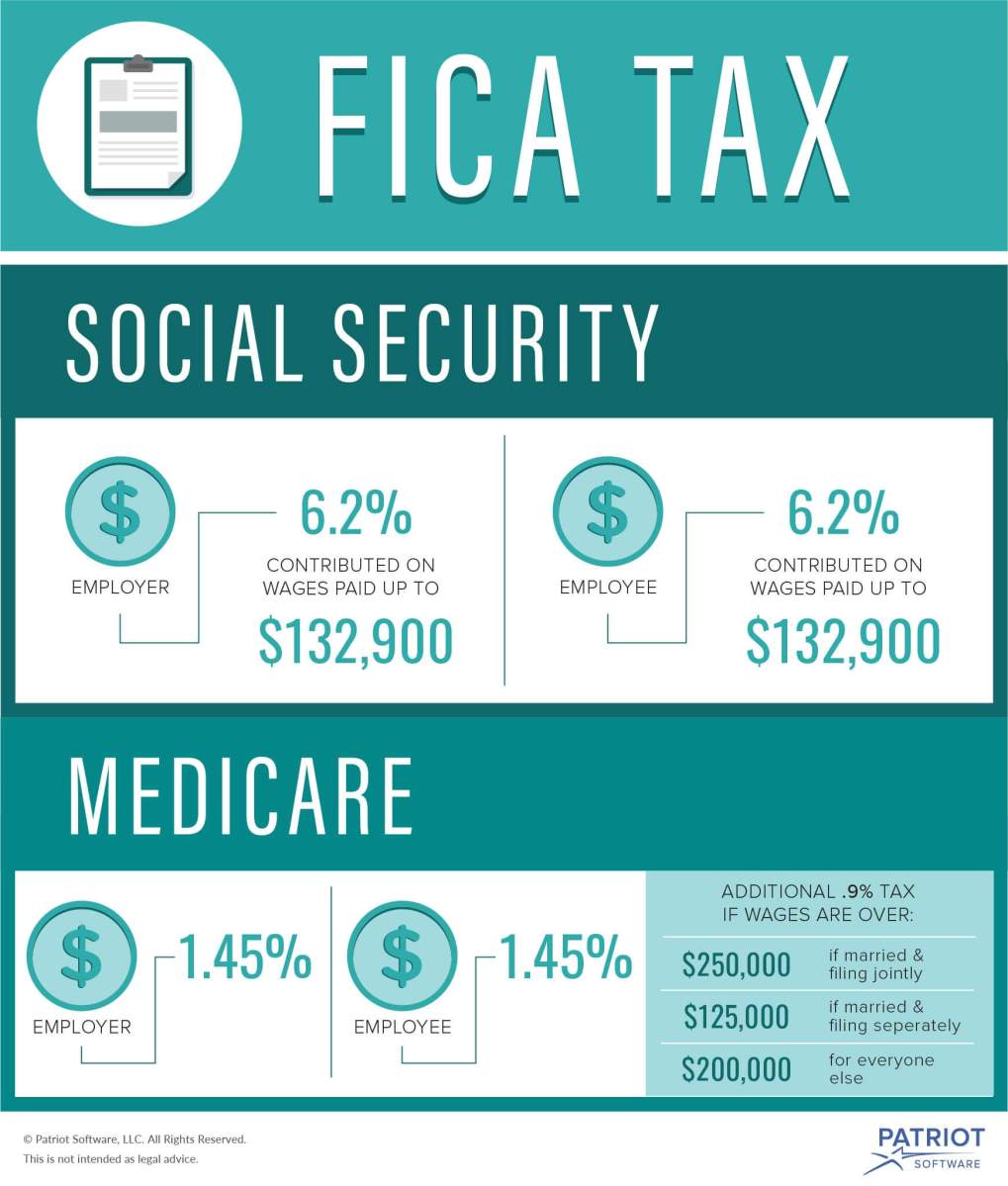

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

Do International Students Pay Taxes? A US Tax Filing Guide

US Taxes for International Students - International Services

The Complete J1 Student Guide to Tax in the US

Tax FAQs International Student Tax Return and Refund

United OPT - Do International Students Need To Pay For Social Security Or Medical Tax Opt Students

Do International Students Pay Taxes? A US Tax Filing Guide

Filing Taxes When You've Been Employed On Campus

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

How to apply for SSN as international student • F1 • H1B • OPT • CPT• Apply for ITIN

USA Student Visa (F1, M1, J1 Visas) Requirements for Indian Students

Immigration Documents - International Student Services - University at Buffalo

Do International Students Pay Taxes? A US Tax Filing Guide

Tax Filing Support International Student and Scholar Services

Top 10 Tax Mistakes Immigrants Make —

Which Employees Are Exempt From Tax Withholding?

de

por adulto (o preço varia de acordo com o tamanho do grupo)