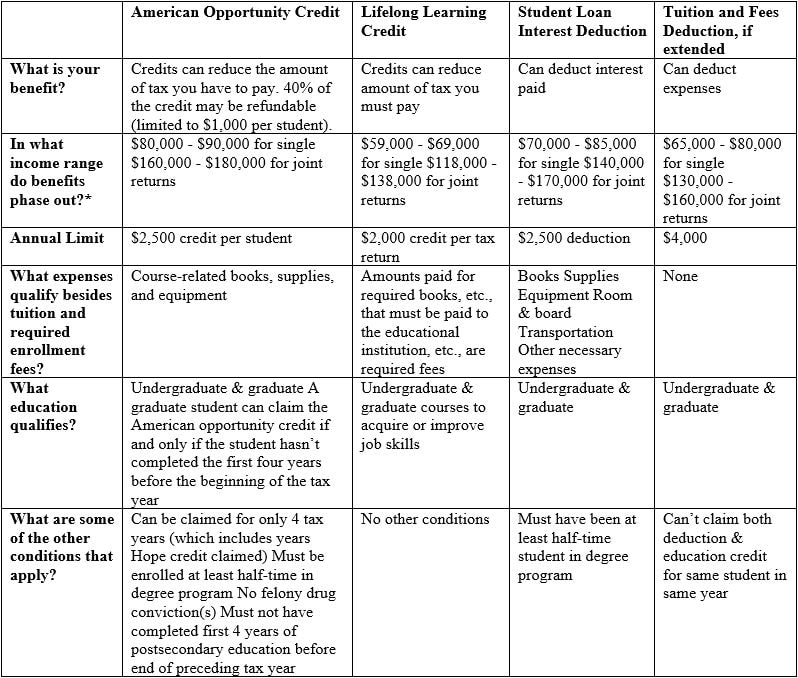

Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

Tax Credit – 1098-T, Student Financial Services

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

IRS 1098-T's and Educational Tax Credits - Rockland Community College

Education Tax Credits – Get It Back

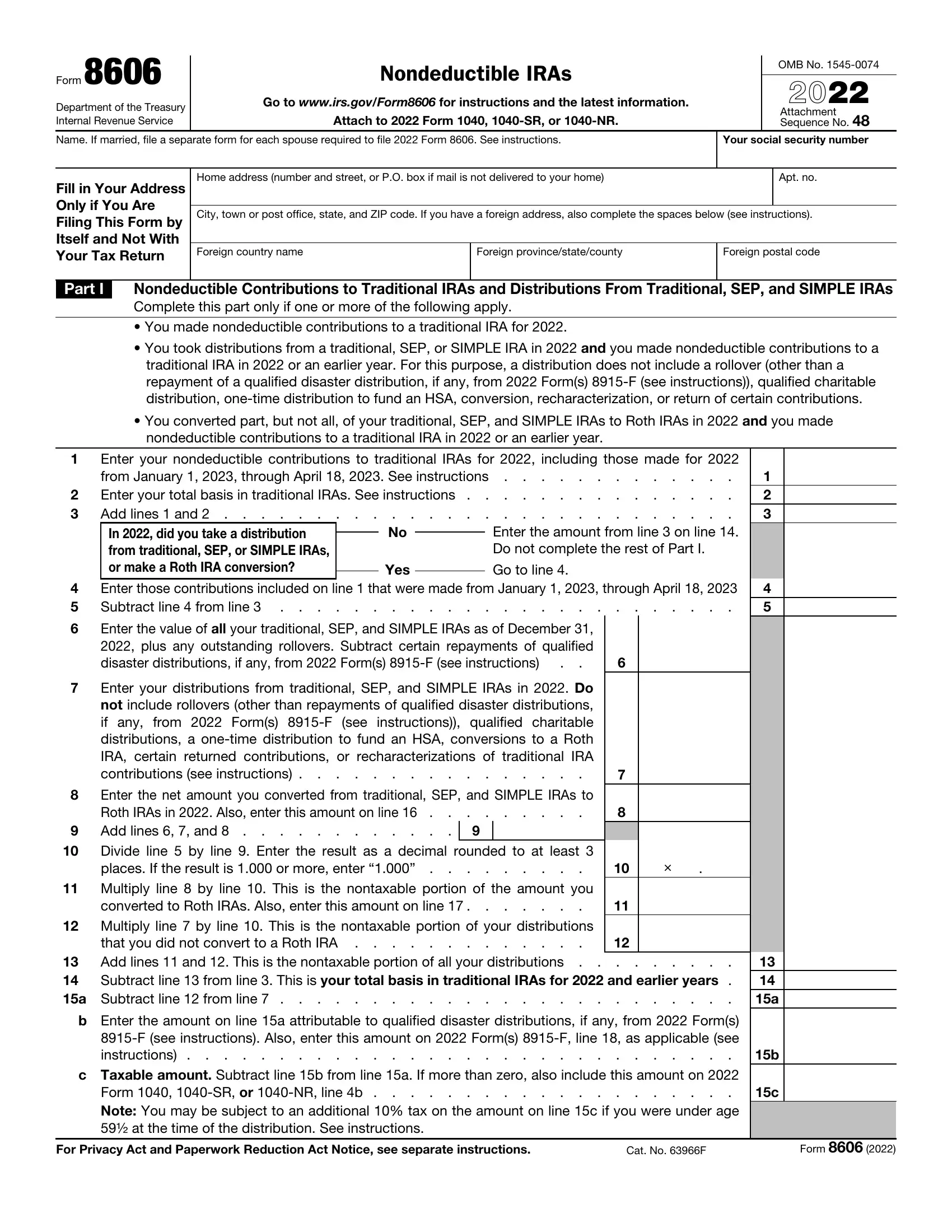

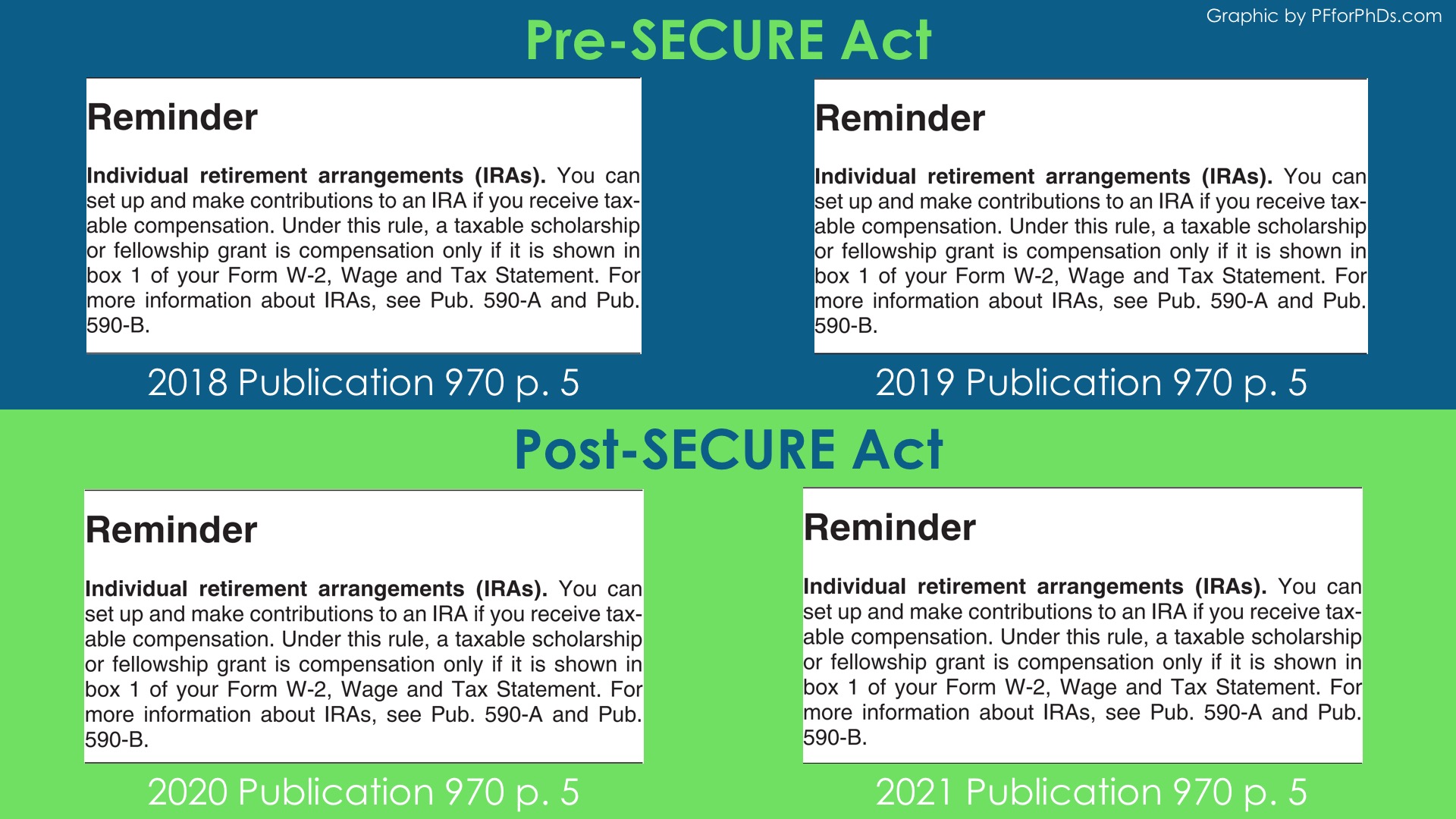

Is Fellowship Income Eligible to Be Contributed to an IRA? - Personal Finance for PhDs

Teacher Expense Income Tax Deduction Raised to $300 - CPA Practice Advisor

Business Office Wayland Baptist University

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Do you have to claim student loans on your taxes?

What Are IRS Publications? - TurboTax Tax Tips & Videos

Is College Tuition Tax-Deductible?

Tuition and Fees Deduction for Higher Education - TurboTax Tax Tips & Videos

de

por adulto (o preço varia de acordo com o tamanho do grupo)