or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Descrição

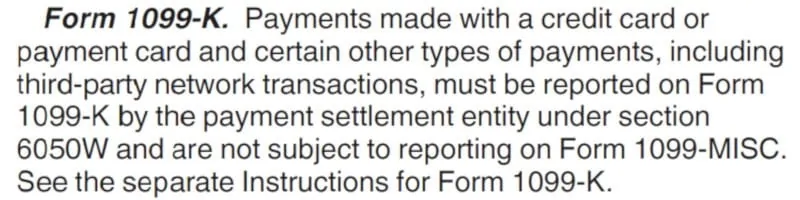

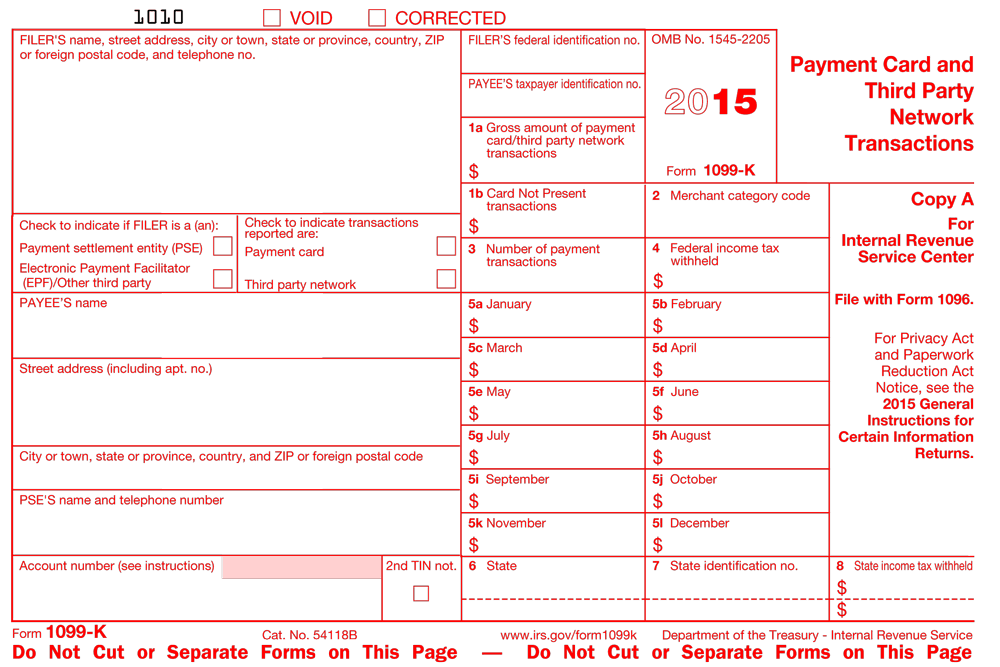

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

Gibson CPA, LLC

Accounting Solutions of Kenosha

Support recommendations and FAQ templates

1099-NEC: When You Should & Shouldn't Be Filing - Eric Nisall

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

The IRS Delays Reporting Changes For Venmo, CashApp And Other Payment Apps – Forbes Advisor

Sandy Dobson CPA PC

Form 1099 Rules for Employers in 2023

What is a 1099-K, How Does It Affect My Business? - VMS

IRS' Venmo crackdown delayed but not dead this holiday season

Guide to 1099 tax forms for Instacart Shopper : Stripe: Help & Support

de

por adulto (o preço varia de acordo com o tamanho do grupo)